News Release

U.S. International Transactions, Third Quarter 2018

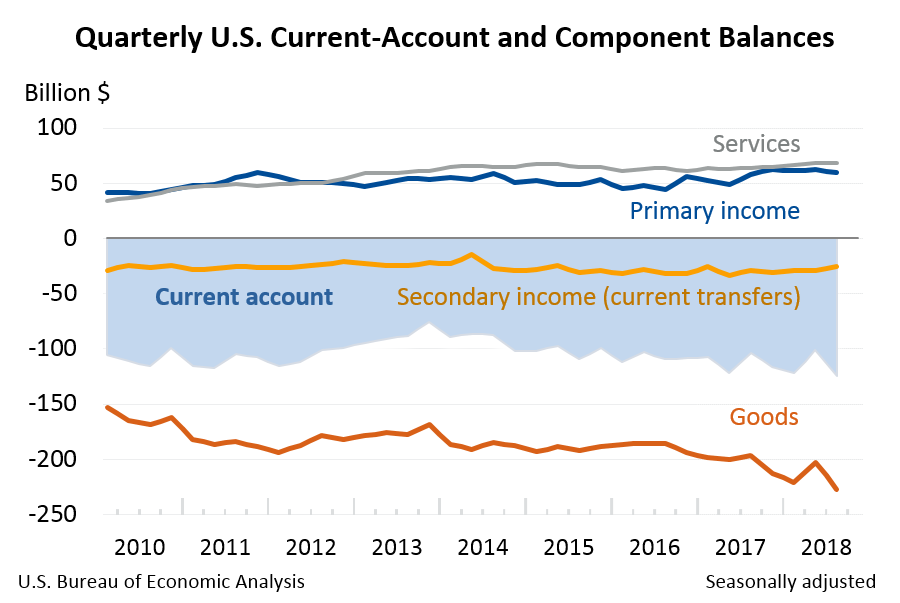

Current-Account Balance

The U.S. current-account deficit increased to $124.8 billion (preliminary) in the third quarter of 2018 from $101.2 billion (revised) in the second quarter of 2018, according to statistics released by the Bureau of Economic Analysis (BEA). The deficit was 2.4 percent of current-dollar gross domestic product (GDP) in the third quarter, up from 2.0 percent in the second quarter.

The $23.6 billion increase in the current-account deficit mainly reflected a $24.0 billion increase in the deficit on goods.

Current-Account Transactions (tables 1-5)

Exports of goods and services and income receipts

Exports of goods and services and income receipts decreased $6.2 billion in the third quarter to $930.3 billion.

- Goods exports decreased $7.7 billion to $421.8 billion, mostly reflecting a decrease in foods, feeds, and beverages, primarily soybeans.

- Primary income receipts decreased $1.8 billion to $264.5 billion, primarily reflecting a decrease in direct investment income. An increase in portfolio investment income partly offset the decrease. For more information on direct investment income, see the box "Effects of the 2017 Tax Cuts and Jobs Act on Components of the International Transactions Accounts."

- Services exports increased $1.8 billion to $207.6 billion, mostly reflecting increases in charges for the use of intellectual property, in financial services, and in other business services, primarily professional and management services.

Imports of goods and services and income payments

Imports of goods and services and income payments increased $17.4 billion in the third quarter to $1,055.1 billion.

- Goods imports increased $16.3 billion to $648.8 billion, mostly reflecting increases in consumer goods, primarily cell phones, in industrial supplies and materials, primarily petroleum and products, and in automotive vehicles, parts, and engines.

Effects of the 2017 Tax Cuts and Jobs Act on Components of the International Transactions Accounts

In the international transactions accounts, income on equity, or earnings, of foreign affiliates of U.S. multinational enterprises in a period consists of a portion that is repatriated to the parent company in the United States in the form of dividends and a portion that is reinvested in foreign affiliates. At times, repatriation of dividends exceeds current-period earnings, resulting in negative values being recorded for reinvested earnings. For the first half of 2018, dividends exceeded earnings, reflecting the repatriation of accumulated prior earnings by foreign affiliates of U.S. multinational enterprises to their parent companies in the United States in response to the 2017 Tax Cuts and Jobs Act (TCJA), which generally eliminates taxes on repatriated earnings. The negative reinvested earnings in the first half of 2018 reflect the fact that U.S. parent companies withdrew accumulated prior earnings from their foreign affiliates. Preliminary statistics for the third quarter show positive reinvested earnings and lower dividends (see table below). The reinvested earnings are also reflected in the net acquisition of direct investment assets in the financial account, which was $76.8 billion in the third quarter and −$207.4 billion in the first half of 2018 (table 6).

| Direct Investment Earnings Billions of dollars, seasonally adjusted |

||||||||||

| 2017 | 2018 | Sum of First Three Quarters |

||||||||

| I | II | III | IV | I | IIr | IIIp | 2017 | 2018 | ||

|---|---|---|---|---|---|---|---|---|---|---|

| Direct investment earnings | 114.1 | 114.4 | 120.3 | 128.9 | 128.1 | 132.9 | 129.8 | 348.8 | 390.8 | |

| Dividends | 38.2 | 34.9 | 55.1 | 26.9 | 294.9 | 183.7 | 92.7 | 128.2 | 571.3 | |

| Reinvested earnings | 75.9 | 79.5 | 65.2 | 102.0 | -166.8 | -50.8 | 37.1 | 220.6 | -180.5 | |

| p Preliminary | r Revised | ||||||||||

For more information, see "How does the 2017 Tax Cuts and Jobs Act affect BEA's business income statistics?" and "How are the international transactions accounts affected by an increase in direct investment dividend receipts?"

In addition to the repatriation of accumulated earnings, some companies made other changes to their business practices in reaction to the TCJA. For example, some insurance companies changed how they operate in response to the base erosion and anti-abuse tax (BEAT) provision of the TCJA. BEAT is a tax on certain payments from a U.S. company to a related foreign party, which can include premium payments for reinsurance. In response to the new tax, many U.S. insurance companies terminated these intracompany reinsurance contracts. As a result, premiums paid by U.S. insurers to foreign insurers in the first three quarters of 2018 were $73.9 billion, down from $98.4 billion for the same period in 2017 (table 3). Similarly, insurance services imports in the first three quarters of 2018 were $28.8 billion, down from $38.2 billion for the same period in 2017.

For more information on the estimation methods used to compile insurance services, see the insurance section in "U.S. International Economic Accounts: Concepts and Methods."

Capital Account (table 1)

Capital transfer receipts were $0.6 billion in the third quarter. The transactions reflected receipts from foreign insurance companies for losses resulting from Hurricane Florence. For information on transactions associated with hurricanes and other disasters, see "How do losses recovered from foreign insurance companies following natural or man-made disasters affect foreign transactions, the current account balance, and net lending or net borrowing?"

Financial Account (tables 1, 6, 7, and 8)

Net U.S. borrowing measured by financial-account transactions was $31.3 billion in the third quarter, a decrease from net borrowing of $153.7 billion in the second quarter.

Financial assets

Net U.S. acquisition of financial assets excluding financial derivatives was $132.7 billion in the third quarter following net U.S. liquidation of $199.9 billion in the second quarter.

- Net U.S. acquisition of direct investment assets was $76.8 billion following net U.S. withdrawal of $68.1 billion in the second quarter. The net withdrawal of direct investment assets in the first half of 2018 reflected U.S. parent repatriation of previously reinvested earnings in response to the TCJA. For more information, see the box "Effects of the 2017 Tax Cuts and Jobs Act on Components of the International Transactions Accounts."

- Net U.S. liquidation of other investment assets decreased $104.1 billion to $16.6 billion. The decrease in the net liquidation mostly reflected a decrease in the net foreign repayment of loans.

- Net U.S. purchases of portfolio investment assets were $72.6 billion following net U.S. sales of $14.3 billion in the second quarter. This change mostly reflected net U.S. purchases of foreign equity and investment fund shares following net sales in the second quarter.

Liabilities

Net U.S. incurrence of liabilities excluding financial derivatives was $151.7 billion in the third quarter following net U.S. repayment of $63.3 billion in the second quarter.

- Net U.S. incurrence of other investment liabilities was $16.9 billion following net U.S. repayment of $100.4 billion in the second quarter. This change primarily reflected net foreign provision of loans following net U.S. repayment in the second quarter.

- Net U.S. incurrence of direct investment liabilities increased $105.8 billion to $122.3 billion, mostly reflecting an increase in equity liabilities.

- Net U.S. incurrence of portfolio investment liabilities decreased $8.1 billion to $12.5 billion. This decrease reflected largely offsetting transactions in U.S. equity and debt liabilities.

Financial derivatives

Transactions in financial derivatives other than reserves reflected third-quarter net borrowing of $12.3 billion, a $4.7 billion decrease in net borrowing from the second quarter.

Statistical Discrepancy (table 1)

The statistical discrepancy was $93.0 billion in the third quarter following a statistical discrepancy of −$52.4 billion in the second quarter.

| Updates to Second Quarter 2018 International Transactions Accounts Aggregate Billions of dollars, seasonally adjusted |

||

| Preliminary estimate | Revised estimate | |

|---|---|---|

| Current-account balance | –101.5 | –101.2 |

| Goods balance | –202.2 | –203.1 |

| Services balance | 69.3 | 68.5 |

| Primary-income balance | 60.8 | 62.3 |

| Secondary-income balance | –28.5 | –29.0 |

| Net lending (+)/borrowing (–) from financial-account transactions | –134.3 | –153.6 |

| Statistical discrepancy | –32.9 | –52.4 |

* * *

Next release: March 27, 2019 at 10:00 A.M. EDT

U.S. International Transactions, Fourth Quarter and Year 2018

* * *

| U.S. International Transactions Release Dates in 2019 | |

|---|---|

| Fourth Quarter and Year 2018 | March 27 |

| First Quarter 2019 and Annual Update | June 20 |

| Second Quarter 2019 | September 19 |

| Third Quarter 2019 | December 19 |