The prices you pay for goods and services change all the time – moving at different rates and even in different directions. Some prices may drop while others are going up. A price index is a way of looking beyond individual price tags to measure overall inflation (or deflation) for a group of goods and services over time.

BEA produces several types of price indexes that help policymakers, business leaders, and consumers see the big pictures of price movements. The Federal Reserve, the central bank of the United States, relies on one of BEA's inflation measures when setting monetary policy. Federal agencies use them to help make spending plans.

U.S. Price Indexes

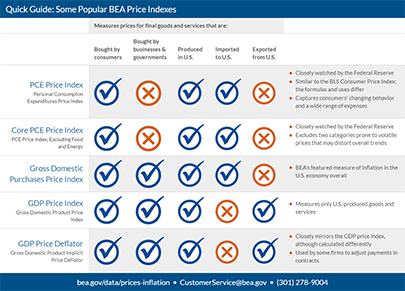

The gross domestic product price index measures changes in prices paid for goods and services produced in the United States, including those exported to other countries. Prices of imports are excluded. The gross domestic product implicit price deflator, or GDP deflator, basically measures the same things and closely mirrors the GDP price index, although the two price measures are calculated differently. The GDP deflator is used by some firms to adjust payments in contracts.

The gross domestic purchases price index is BEA's featured measure of inflation for the U.S. economy overall. It measures changes in prices paid by consumers, businesses, and governments in the United States, including the prices of the imports they buy.

BEA's closely followed personal consumption expenditures price index, or PCE price index, is a narrower measure. It looks at the changing prices of goods and services purchased by consumers in the United States. It's similar to the Bureau of Labor Statistics' consumer price index for urban consumers. The two indexes, which have their own purposes and uses, are constructed differently, resulting in different inflation rates.

The PCE price index is known for capturing inflation (or deflation) across a wide range of consumer expenses and for reflecting changes in consumer behavior. For example, if the price of beef rises, shoppers may buy less beef and more chicken. Also, BEA revises previously published PCE data to reflect updated information or new methodology, providing consistency across decades of data that's valuable for researchers. The PCE price index is used primarily for macroeconomic analysis and forecasting.

A variation is the personal consumption expenditures price index, excluding food and energy, also known as the core PCE price index. The core index makes it easier to see the underlying inflation trend by excluding two categories – food and energy – where prices tend to swing up and down more dramatically and more often than other prices. The core PCE price index is closely watched by the Federal Reserve as it conducts monetary policy.

State and Metro Prices

Considering a job offer in a more expensive city? Looking for an affordable place to retire? Our regional price indexes can help.

You can compare buying power across the 50 states and the District of Columbia, or from one metropolitan area to another, by using BEA's Regional Price Parities. State and metro price levels are expressed as a percentage of the overall national level.

Health Care Prices

BEA's special health care statistics include price indexes for treatments of different types of diseases. The Health Care Satellite Account looks at spending more like a patient does; it measures health care not as types of goods and services, such as a doctor's visit or hospital stay, but by the type of disease being treated, such as cancer or heart trouble.

These statistics in the Health Care Satellite Account are helping answer questions like:

- Which diseases cause the most spending?

- For which diseases is the price of treatment rising fastest?

- When spending on a disease rises, is it because prices rose or because more people got treatment?

Learn more:

- NIPA Handbook: Chapter 2: Fundamental Concepts

- A Reconciliation between the Consumer Price Index and the Personal Consumption Expenditures Price Index

- For more about the Health Care Satellite Account and other special topics, see the Special Topics learning page.