The same BE-10 filing requirements apply to private funds as to other domestic and foreign entities.

Per the BE-10, Benchmark Survey of U.S. Direct Investment Abroad Instruction Booklet (located at BE-10 respondents webpage):

Forms comprising a BE-10 report are:

- Form BE-10A – Report for U.S. Reporter;

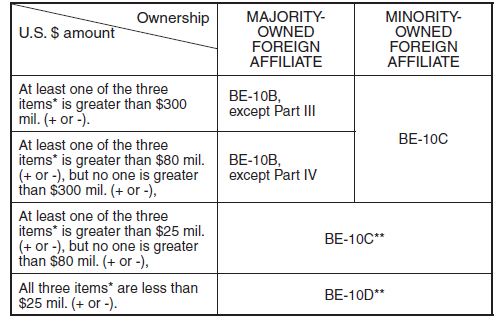

- Form BE-10B – Report for majority-owned foreign affiliates of U.S. parents with assets, sales, or net income greater than $80 million (positive or negative);

- Form BE-10C – Report for majority-owned foreign affiliates of U.S. parents with assets, sales, or net income greater than $25 million (positive or negative), but no one of these items was greater than $80 million (positive or negative); for minority-owned foreign affiliates of U.S. parents with assets, sales, or net income greater than $25 million (positive or negative); and for foreign affiliates for which none of assets, sales, or net income was greater than $25 million (positive or negative), and is a foreign affiliate parent of another foreign affiliate being filed on Form BE-10B or BE-10C;

- Form BE-10D – Report for foreign affiliates for which none of assets, sales, or net income was greater than $25 million (positive or negative), and is not a foreign affiliate parent of another foreign affiliate being filed on Form BE-10B or BE-10C.

*Total assets, sales or gross operating revenues excluding sales taxes, net income (loss) after provision for foreign income taxes.

Published