Consumer Spending

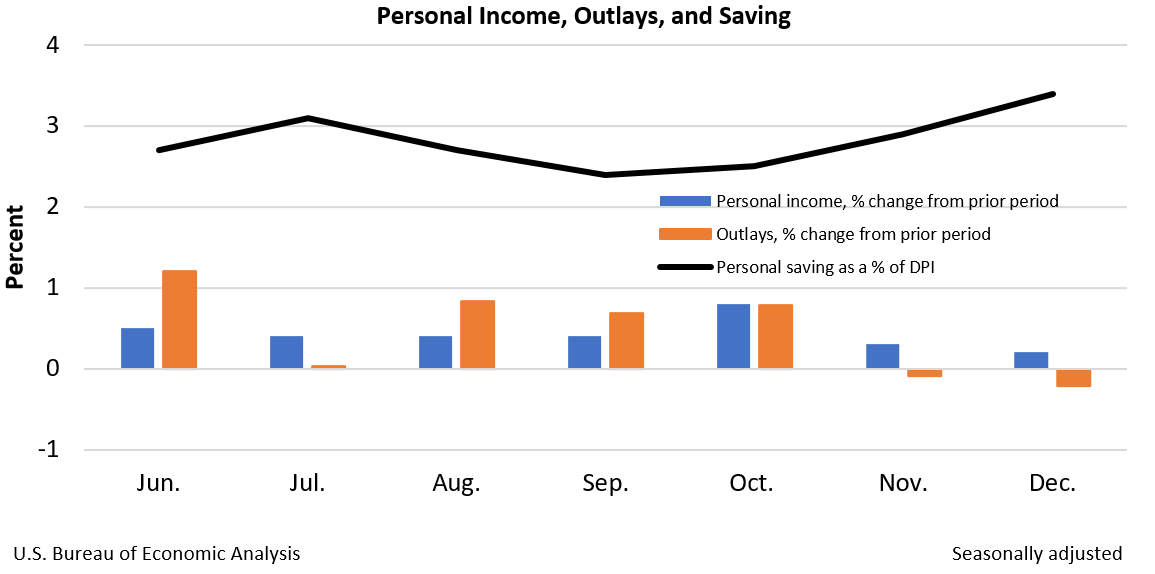

Personal Income and Outlays, December 2022

|

December 2022

|

+0.2%

|

|

November 2022

|

+0.3%

|

Personal income increased $49.5 billion, or 0.2 percent at a monthly rate, while consumer spending decreased $41.6 billion, or 0.2 percent, in December. The increase in personal income primarily reflected increases in compensation and proprietors’ income. The personal saving rate (that is, personal saving as a percentage of disposable personal income) was 3.4 percent in December, compared with 2.9 percent in November.

- Current release: January 27, 2023

- Next release: February 24, 2023

Personal Income and Outlays, November 2022

|

November 2022

|

+0.4%

|

|

October 2022

|

+0.7%

|

Personal income increased $80.1 billion, or 0.4 percent at a monthly rate, while consumer spending increased $19.8 billion, or 0.1 percent, in November. The increase in personal income primarily reflected increases in compensation and personal income receipts on assets. The personal saving rate (that is, personal saving as a percentage of disposable personal income) was 2.4 percent in November, compared with 2.2 percent in October.

- Current release: December 23, 2022

- Next release: January 27, 2023

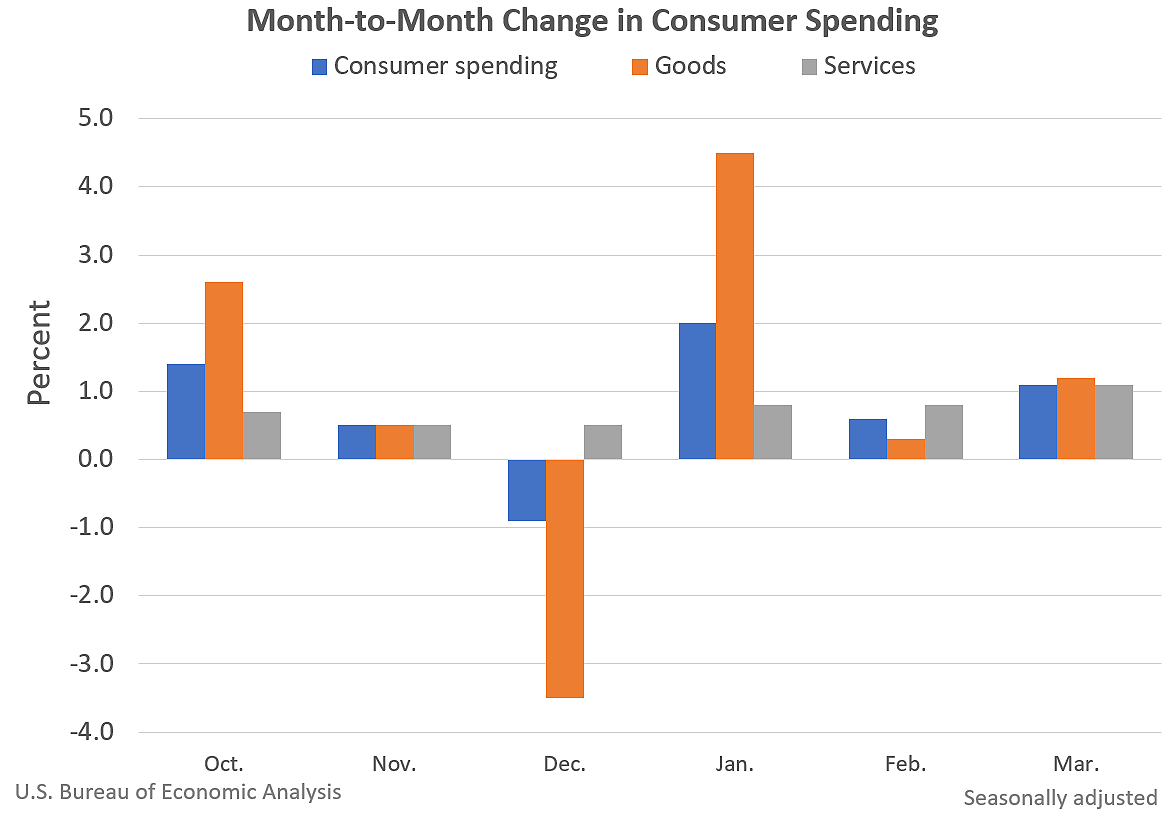

Personal Income and Outlays, October 2022

|

October 2022

|

+0.7%

|

|

September 2022

|

+0.4%

|

Personal income increased $155.3 billion, or 0.7 percent at a monthly rate, while consumer spending increased $147.9 billion, or 0.8 percent, in October. The increase in personal income primarily reflected increases in compensation and personal current transfer receipts. The personal saving rate (that is, personal saving as a percentage of disposable personal income) was 2.3 percent in October, compared with 2.4 percent in September.

- Current release: December 1, 2022

- Next release: December 23, 2022

Personal Income and Outlays, September 2022

|

September 2022

|

+0.4%

|

|

August 2022

|

+0.4%

|

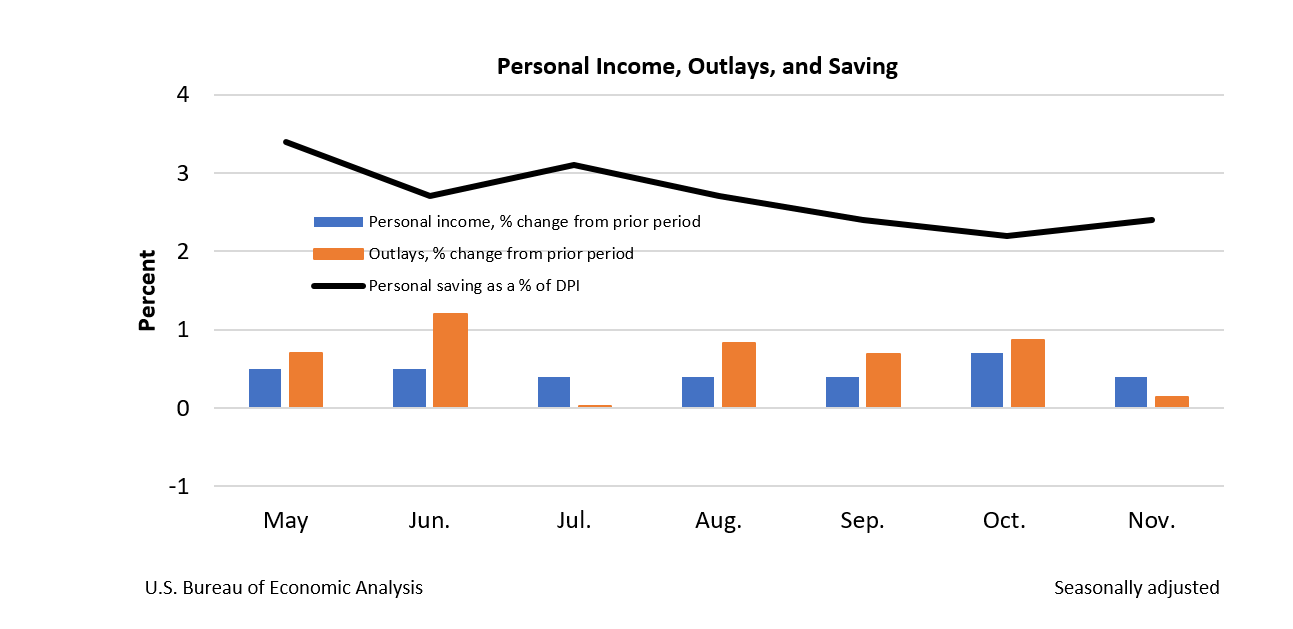

Personal income increased $78.9 billion, or 0.4 percent at a monthly rate, while consumer spending increased $113.0 billion, or 0.6 percent, in September. The increase in personal income primarily reflected increases in compensation and personal income receipts on assets. The personal saving rate (that is, personal saving as a percentage of disposable personal income) was 3.1 percent in September, compared with 3.4 percent in August.

- Current release: October 28, 2022

- Next release: December 1, 2022

Personal Income and Outlays, August 2022 and Annual Update

|

August 2022

|

+0.3%

|

|

July 2022

|

+0.3%

|

Personal income increased $71.6 billion, or 0.3 percent at a monthly rate, while consumer spending increased $67.5 billion, or 0.4 percent, in August. The increase in personal income primarily reflected increases in compensation and proprietors’ income. The personal saving rate (that is, personal saving as a percentage of disposable personal income) was 3.5 percent in August, the same rate as in July.

- Current release: September 30, 2022

- Next release: October 28, 2022

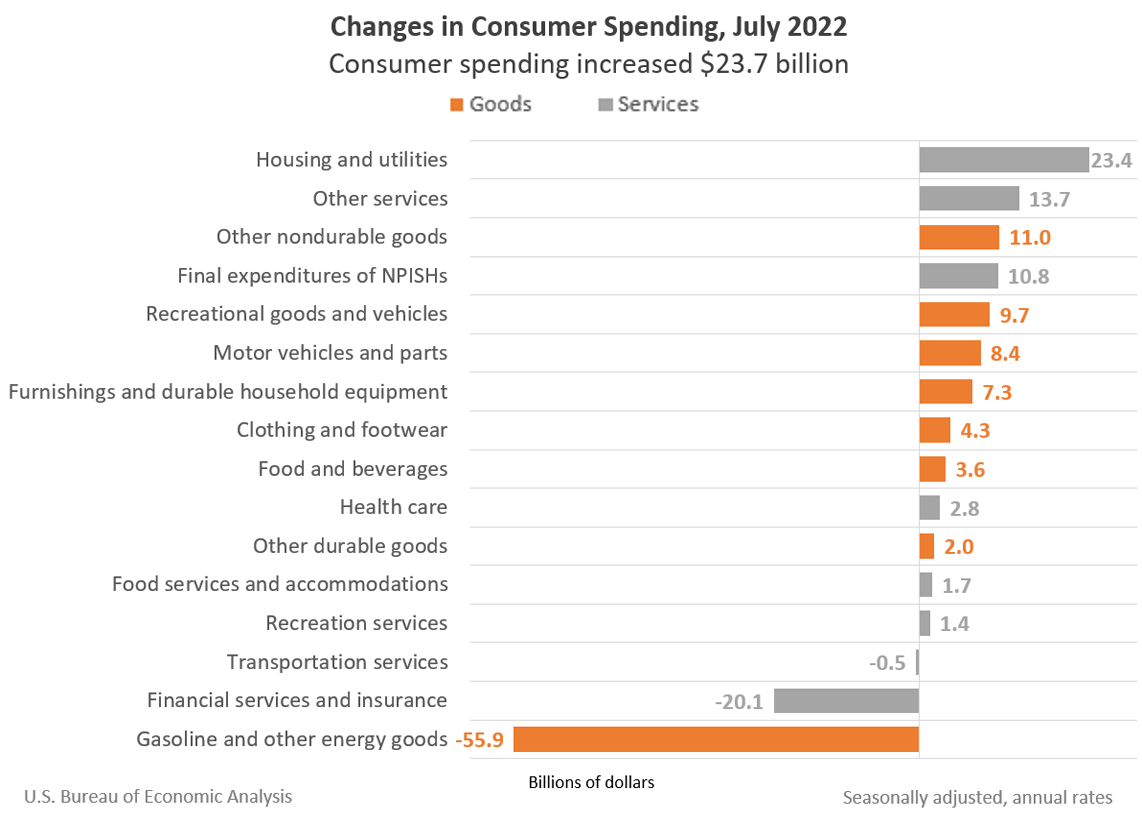

Personal Income and Outlays, July 2022

|

July 2022

|

+0.2%

|

|

June 2022

|

+0.7%

|

Personal income increased $47.0 billion, or 0.2 percent at a monthly rate, while consumer spending increased $23.7 billion, or 0.1 percent, in July. The increase in personal income primarily reflected an increase in compensation. The personal saving rate (that is, personal saving as a percentage of disposable personal income) was 5.0 percent in July, the same rate as in June.

- Current release: August 26, 2022

- Next release: September 30, 2022

Personal Income and Outlays, June 2022

|

June 2022

|

+0.6%

|

|

May 2022

|

+0.6%

|

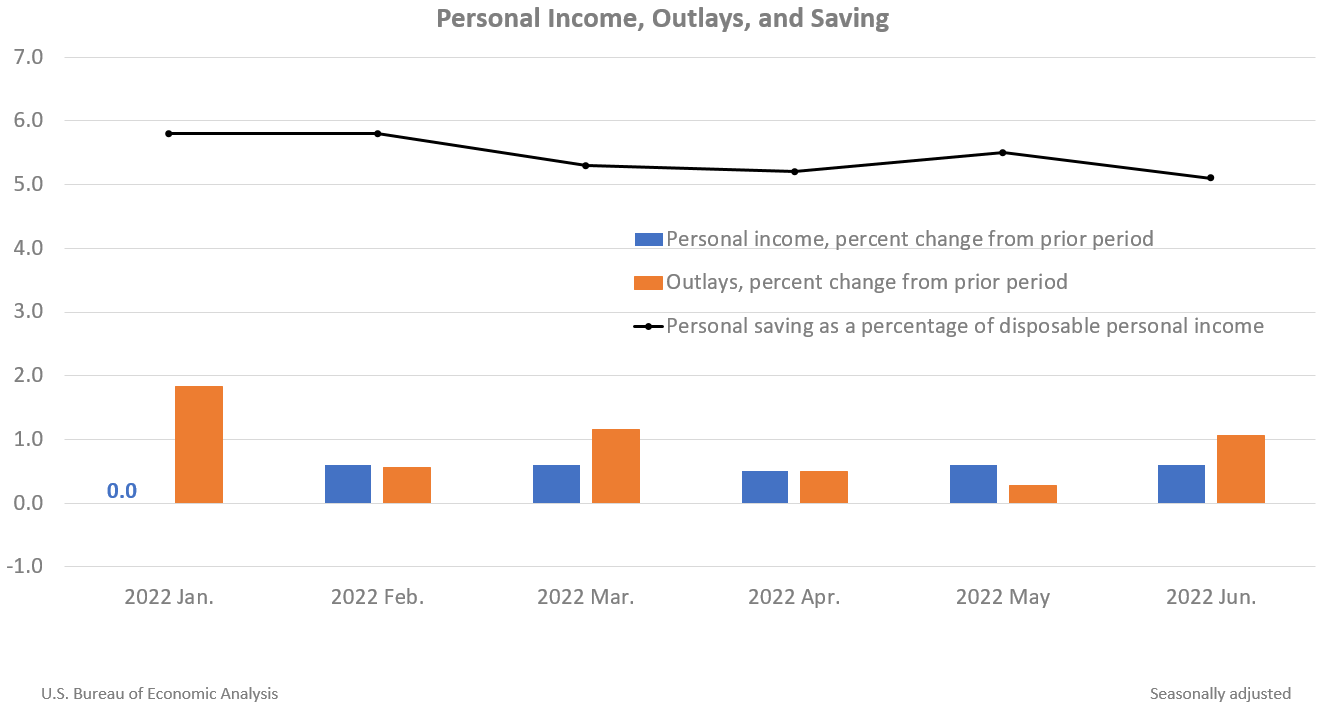

Personal income increased $133.5 billion, or 0.6 percent at a monthly rate, while consumer spending increased $181.1 billion, or 1.1 percent, in June. The increase in personal income primarily reflected increases in compensation and proprietors’ income. The personal saving rate (that is, personal saving as a percentage of disposable personal income) was 5.1 percent in June, compared with 5.5 percent in May.

- Current release: July 29, 2022

- Next release: August 26, 2022

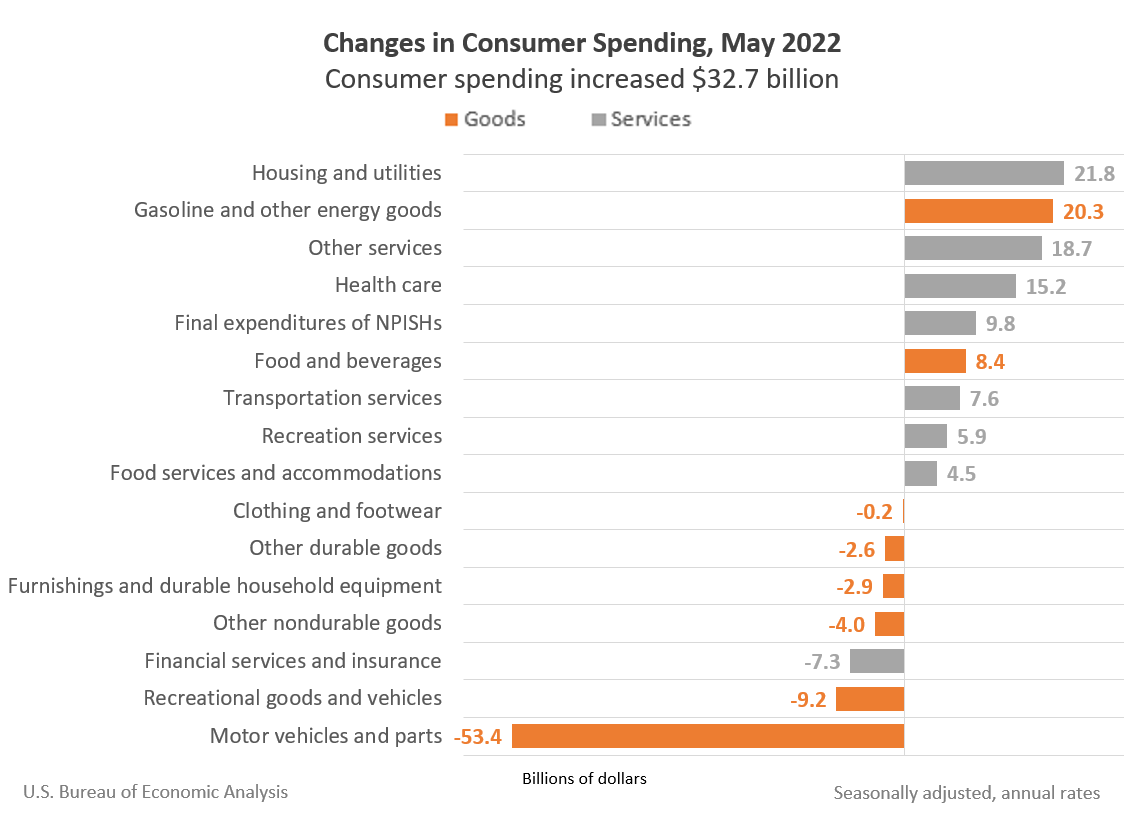

Personal Income and Outlays, May 2022

|

May 2022

|

+0.5%

|

|

April 2022

|

+0.5%

|

Personal income increased $113.4 billion, or 0.5 percent at a monthly rate, while consumer spending increased $32.7 billion, or 0.2 percent, in May. The increase in personal income primarily reflected an increase in compensation. The personal saving rate (that is, personal saving as a percentage of disposable personal income) was 5.4 percent in May, compared with 5.2 percent in April.

- Current release: June 30, 2022

- Next release: July 29, 2022

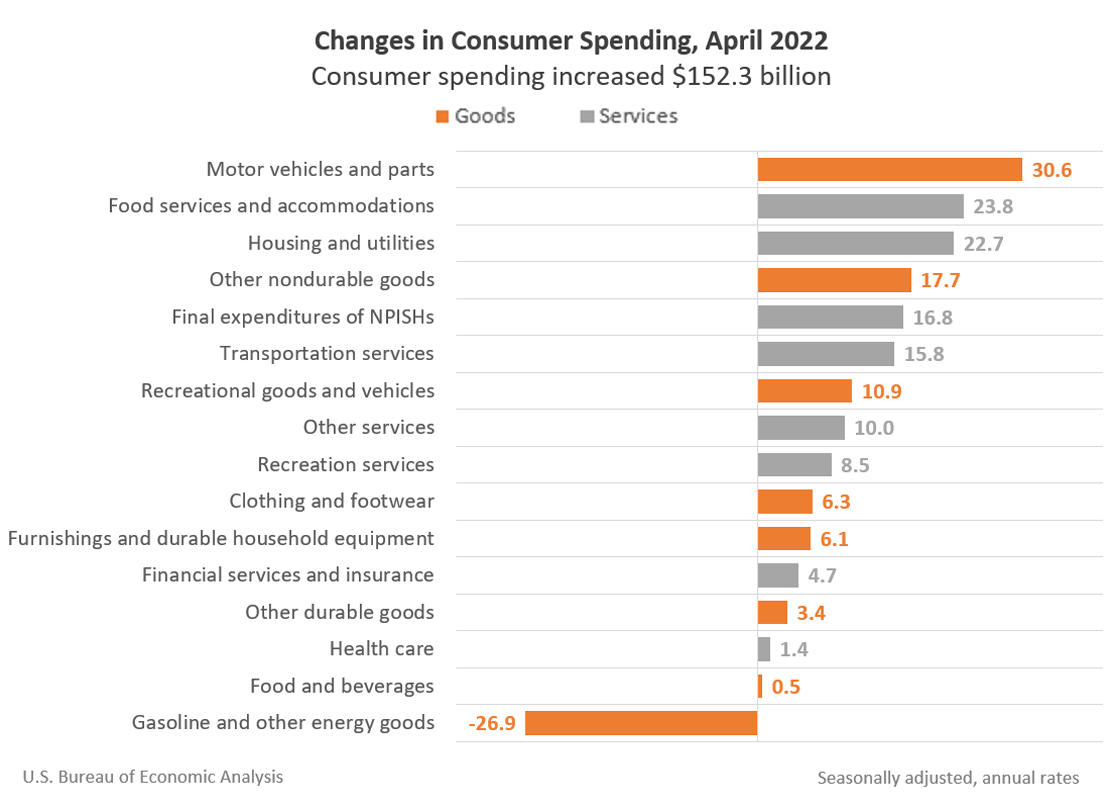

Personal Income and Outlays, April 2022

|

April 2022

|

+0.4%

|

|

March 2022

|

+0.5%

|

Personal income increased $89.3 billion, or 0.4 percent at a monthly rate, while consumer spending increased $152.3 billion, or 0.9 percent, in April. The increase in personal income primarily reflected an increase in compensation. The personal saving rate (that is, personal saving as a percentage of disposable personal income) was 4.4 percent in April, compared with 5.0 percent in March.

- Current release: May 27, 2022

- Next release: June 30, 2022

Personal Income and Outlays, March 2022

|

March 2022

|

+0.5%

|

|

February 2022

|

+0.7%

|

Personal income increased $107.2 billion, or 0.5 percent at a monthly rate, while consumer spending increased $185.0 billion, or 1.1 percent, in March. The increase in personal income primarily reflected an increase in compensation. The personal saving rate (that is, personal saving as a percentage of disposable personal income) was 6.2 percent in March, compared with 6.8 percent in February.

- Current release: April 29, 2022

- Next release: May 27, 2022