News Release

Foreign Direct Investment by Country and Industry, 2016

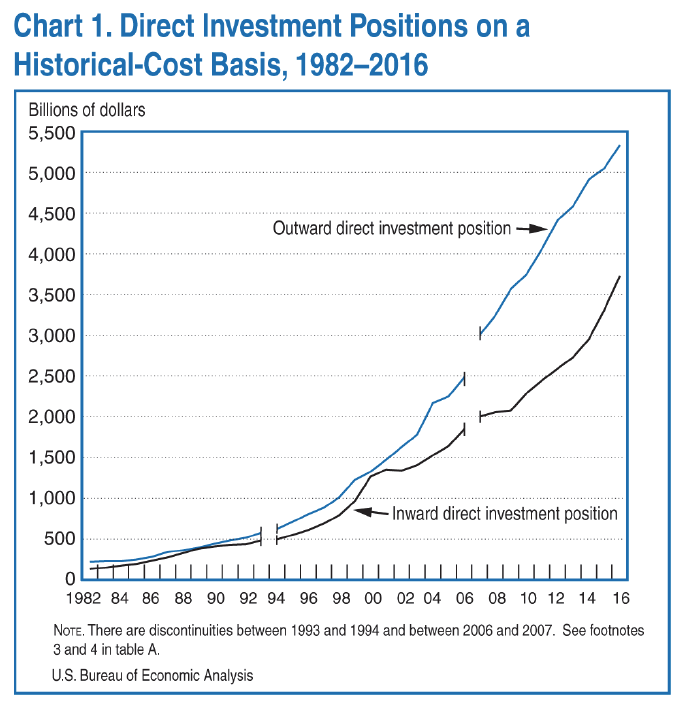

Outward and Inward U.S. foreign direct investment continued to grow in 2016. The U.S. direct investment position abroad valued at historical cost grew 5.6 percent to $5,332.2 billion, compared with an average annual growth rate of 8.2 percent in 2006–2015. The foreign direct investment position in the United States valued at historical cost grew 12.8 percent to $3,725.4 billion, compared with an average annual growth rate of 6.7 percent in 2006–2015.

Outward direct investment

Five host countries—the Netherlands, the United Kingdom, Luxembourg, Ireland, and Canada—accounted for more than half of the total position at the end of 2016. For the eighth consecutive year, the position in the Netherlands was the largest—at $847.4 billion, or 15.9 percent of the total. Four-fifths of the position in the Netherlands was accounted for by holding companies that likely invested funds in other countries. The position in the United Kingdom was $682.4 billion, or 12.8 percent of the total position; nearly three-fourths of the position was accounted for by holding companies and finance and insurance. In Luxembourg, the position was $607.8 billion, or 11.4 percent of the total; holding companies accounted for most of the position. The position in Ireland was $387.1 billion, or 7.3 percent of the total, and in Canada, it was $363.9 billion, or 6.8 percent of the total.

Inward direct investment

The top five investing countries accounted for more than half of the overall foreign direct investment position in the United States. The United Kingdom was the largest investing country with a position of $555.7 billion, or 14.9 percent of the total. Japan was the second-largest investing country with a position of $421.1 billion, or 11.3 percent of the total. Luxembourg was the third largest with a position of $417.4 billion, Canada was the fourth largest with a position of $371.5 billion, and the Netherlands was the fifth largest with a position of $355.2 billion. These investments are classified by the country of the first owner outside the United States with a direct claim on the U.S. affiliate. Additional statistics are also available by ultimate beneficial owner.