News Release

Real Personal Income for States and Metropolitan Areas, 2007-2011 (prototype estimate)

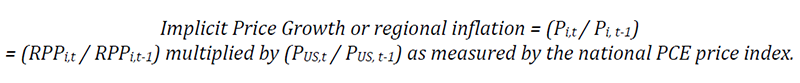

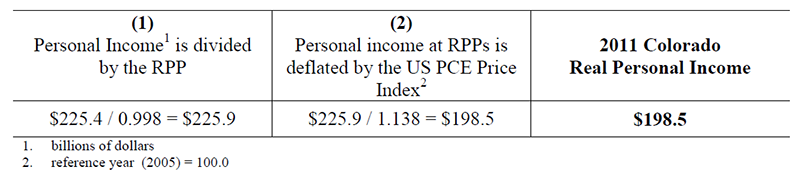

Today, the U.S. Bureau of Economic Analysis released experimental real, or inflation-adjusted, estimates of personal income for states and metropolitan areas. The inflation-adjustments are based in part on regional price parities (RPPs) that provide a measure of differences in price levels across each state and region relative to the national price level for each of the years, 2007-2011. When RPPs are applied in conjunction with BEA’s national Personal Consumption Expenditures (PCE) price index, which measures price changes over time, personal income comparisons can be made across regions and time periods (see Technical Note). These prototype statistics are being released for evaluation and comment by data users.

Real Personal Income for States and Metropolitan Areas1

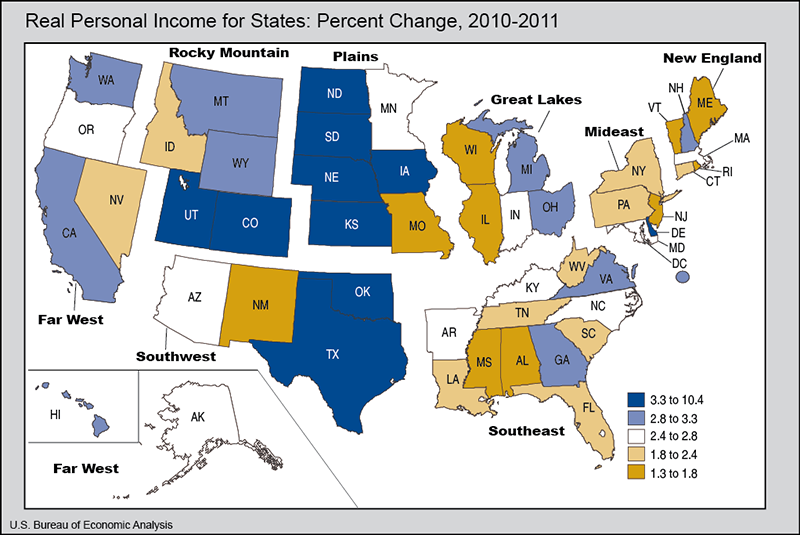

Real personal income across all regions rose by an average of 2.7% in 2011, after rising 1.9% in 2010. These growth rates reflect the year-over-year change in nominal personal income across all regions adjusted by the change in the national PCE price index. On a nominal basis, personal income across all regions grew an average of 5.2% in 2011, after rising 3.8% in 2010. In 2011, the U.S. PCE price index grew 2.4% after rising 1.9% in 2010.

Growth in real state personal income from 2010 to 2011 ranged from 1.3% in Mississippi to 10.4% in South Dakota. These growth rates reflect the year-over-year change in the state’s nominal personal income, the change in the national PCE price index, and the change in the regional price parity for that state. After South Dakota, the states with the largest growth rates of real personal income are North Dakota (9.5%), Iowa (6.1%), Nebraska (6.0%), and Texas (4.3%). The states with smallest growth rates after Mississippi are Maine (1.4%), Rhode Island (1.5%), Vermont (1.6%), and New Mexico (1.6%). Four states – Arizona, Indiana, North Carolina, and Oregon – had growth rates equal to the national average of 2.7%.

Growth in real metropolitan area personal income from 2010 to 2011 ranged from a decline of 0.7% in Rochester, MN to an increase of 11.9% in Odessa, TX. After Odessa, TX, the metropolitan areas with largest growth rates of real personal income were Midland, TX (10.7%), Hanford-Corcoran, CA (6.7%), San Jose-Sunnyvale-Santa Clara, CA (6.4%), and Madera-Chowchilla, CA (6.2%). In addition to Rochester, MN, four metropolitan areas had declining or flat growth rates. These are Ocean City, NJ (-0.3%), Anniston-Oxford, AL (-0.2%), Gadsden, AL (-0.2%), and Cape Girardeau-Jackson, MO-IL (0.0%).

Regional Price Parities

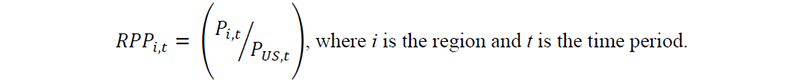

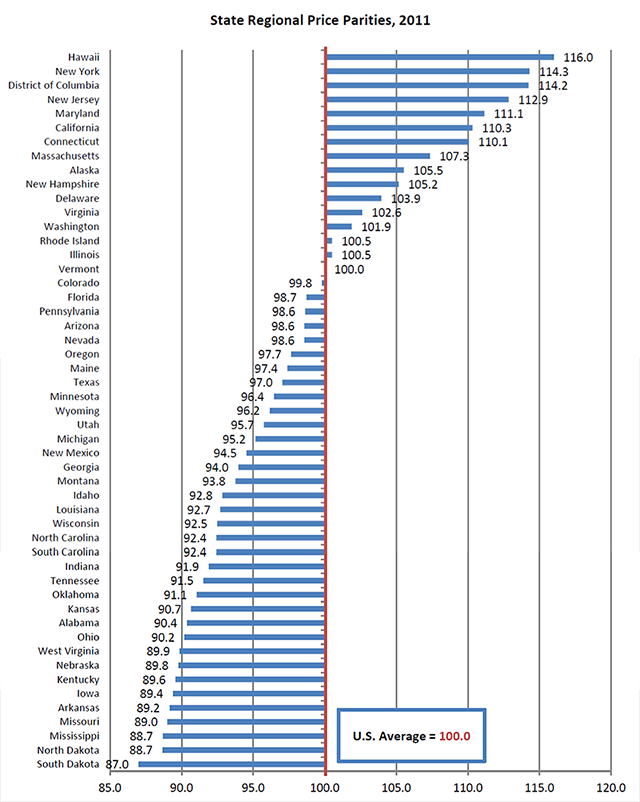

Regional Price Parities (RPPs) measure the differences in the price levels of goods and services across states and metropolitan areas for a given year. RPPs are expressed as a percentage of the overall national price level for each year, which is equal to 100.0.

In 2011, the states with the highest RPPs were Hawaii (116.0), New York (114.3), and the District of Columbia (114.2). High RPPs in these states were driven by the relatively high price level of rents and other services. South Dakota (87.0), North Dakota (88.7), and Mississippi (88.7) had the lowest RPPs among the States. States with low RPPs typically have lower price levels for rents and other services, while the price level for goods is relatively higher. States with RPPs close or equal to the national average price level were Colorado (99.8), Illinois (100.5), Rhode Island (100.5), and Vermont (100.0).

In 2011, the metropolitan area with the highest RPP was Bridgeport-Stamford-Norwalk, CT (122.3). Metropolitan areas with RPPs above 120.0 also include Honolulu, HI (121.0), Poughkeepsie-Newburgh-Middletown, NY (120.6), and New York-Northern New Jersey-Long Island, NY-NJ-PA (120.5). The metropolitan area with lowest RPP was Jefferson City, MO (81.0), followed by Morristown, TN (82.3), Danville, IL (82.5), and Cape Girardeau-Jackson, MO-IL (82.9).

Technical Note on Real Personal Income for States and Metropolitan Areas

Definitions

Next Steps

These data are prototype statistics in that they are being released for evaluation and comment by data users. There has been substantial interest in these statistics, and BEA hopes to produce real state and metropolitan area personal income as annual series in the future. If you have comments or suggestions, please send these to rpp@bea.gov.

* * *

The state tables in this press release are also available on the BEA website. Additional tables showing estimates of real income and regional price parities can also be found there for:

- State metropolitan and non-metropolitan portions, 2007-2011

- Metropolitan areas, 2009-2011

BEA’s national, international, regional, and industry statistics; the Survey of Current Business; and BEA news releases are available without charge on BEA’s web site at www.bea.gov. By visiting the site, you can also subscribe to receive free e-mail summaries of BEA releases and announcements.

Next real personal income release – June 2014 for states, state metropolitan and nonmetropolitan portions, and metropolitan areas.

1 Metropolitan areas consist of the 366 Metropolitan Statistical Areas defined by the U.S. Office of Management and Budget (OMB) as one or more counties with a high degree of social and economic integration, with a core urban population of 50,000 or more. Combining the metropolitan areas with the non-metropolitan portion of the United States provides complete coverage of all U.S. counties.

2 The Geary RPP indexes are Paasche-type indexes that compare area prices with national prices. National prices are defined as quantity weighted averages of the local area prices of each good. The national prices and the RPPs are solved for simultaneously.

3 The CPI represents about 87% of the total U.S. population, including almost all residents of urban or metropolitan areas. Rural area prices (exclusive of Rents) are assumed to be the same as those in the urban, non-metropolitan areas of the CPI.

4 RPP should first be divided by 100.