News Release

State Quarterly Personal Income, 1st quarter 2001-2nd quarter 2013; State Annual Personal Income, 2001-2012 (benchmark estimate)

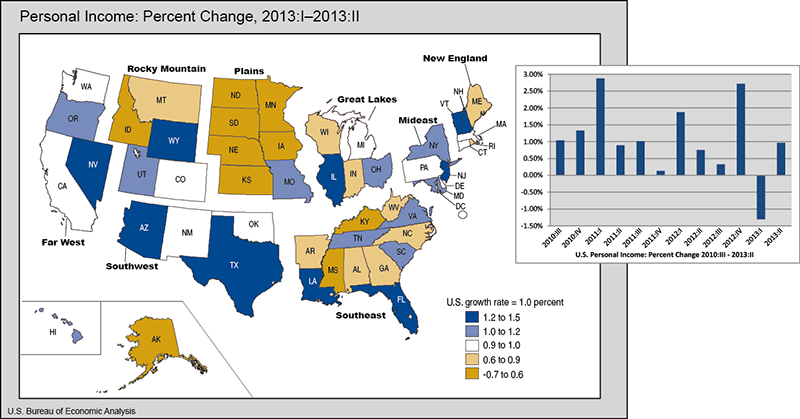

State personal incomes grew 1.0 percent on average in the second quarter of 2013 after falling 1.3 percent in the first quarter, according to estimates released today by the U.S. Bureau of Economic Analysis. Personal income growth ranged from 1.5 percent in Florida and Arizona to -0.7 percent in Nebraska. The national price index for personal consumption expenditures was unchanged in the second quarter after rising 0.3 percent in the first quarter.

The first-quarter declines in state personal income mainly reflected the effects of special factors, such as the expiration of the payroll tax holiday and the acceleration of bonuses and personal dividends to the fourth quarter of 2012 in anticipation of changes in individual tax rates. Second-quarter growth completely offset the first-quarter personal income decline in 20 states and the District of Columbia.

Earnings by stage and industry. U.S. farm earnings fell 14.6 percent in the second quarter. Personal income fell in South Dakota, Iowa, and Nebraska as the declines in farm earnings in those states more than offset growth in all other components of income.

Private nonfarm earnings for the nation grew 1.0 percent in the second quarter, matching the average for the last four years. Growth was above the national average in North Dakota (1.6 percent), Louisiana (1.5 percent), Texas (1.3 percent), and Wyoming (1.2 percent) with mining and construction making the largest contributions to their private nonfarm earnings growth. Nebraskas private nonfarm earnings grew 0.5 percent, the smallest increase of all states in the second quarter of 2013. Nebraska was the only state with a decline in finance earnings (0.9 percent) and one of only two states where construction earnings fell. Construction earnings fell 0.5 percent in Nebraska and 0.9 percent in Nevada.

The compensation of federal employees fell in most states in the second quarter. Overall, civilian federal government earnings fell 0.8 percent, military earnings rose 0.2 percent, and state and local government earnings were essentially unchanged.

Dividends, interest, and rent. Dividends, interest, and rent (property income) increased $75.5 billion in the second quarter after falling $107.4 billion in the first. The level of personal dividend income was reduced in the first quarter reflecting accelerated and special dividend distributions paid in the fourth quarter of 2012 in anticipation of changes to individual income tax rates. The property income increase was especially notable in Florida where it accounted for more than half of the states second quarter personal income growth, which was the highest of all states.

Today, the Bureau of Economic Analysis (BEA) begins releasing the results of a comprehensive (or benchmark) revision of its quarterly and annual state personal income statistics. Initially, new and revised statistics have been released for the years and quarters covered by the North American Industry Classification System; i.e., from the first quarter of 2001 through the second quarter of 2013. Revisions back to 1929 for the annual estimates and back to the first quarter of 1948 for the quarterly statistics are scheduled to be released in the spring of 2014.

1NOTE.— Quarter-to-quarter percent changes are calculated from unrounded data and are not annualized. Quarterly estimates are expressed at seasonally adjusted annual rates, unless otherwise specified. Quarter-to-quarter dollar changes are differences between published estimates.

Definitions

Personal income is the income received by all persons from all sources. Personal income is the sum of net earnings by place of residence, property income, and personal current transfer receipts. Property income is rental income of persons, personal dividend income, and personal interest income. Net earnings is earnings by place of work (the sum of wages and salaries, supplements to wages and salaries, and proprietors income) less contributions for government social insurance, plus an adjustment to convert earnings by place of work to a place-of-residence basis. Personal income is measured before the deduction of personal income taxes and other personal taxes and is reported in current dollars (no adjustment is made for price changes).

The estimate of personal income in the United States is derived as the sum of the state estimates and the estimate for the District of Columbia; it differs from the estimate of personal income in the national income and product accounts (NIPAs) because of differences in coverage, in the methodologies used to prepare the estimates, and in the timing of the availability of source data.

BEA groups all 50 states and the District of Columbia into eight distinct regions for purposes of data collecting and analyses: New England (Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island, and Vermont); Mideast (Delaware, District of Columbia, Maryland, New Jersey, New York, and Pennsylvania); Great Lakes (Illinois, Indiana, Michigan, Ohio, and Wisconsin); Plains (Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota, and South Dakota); Southeast (Alabama, Arkansas, Florida, Georgia, Kentucky, Louisiana, Mississippi, North Carolina, South Carolina, Tennessee, Virginia, and West Virginia); Southwest (Arizona, New Mexico, Oklahoma, and Texas); Rocky Mountain (Colorado, Idaho, Montana, Utah, and Wyoming); and Far West (Alaska, California, Hawaii, Nevada, Oregon, and Washington).

State personal income statistics provide a framework for analyzing current economic conditions in each state and can serve as a basis for decision making. For example:

- Federal government agencies use the statistics as a basis for allocating funds and determining matching grants to states. The statistics are also used in forecasting models to project energy and water use.

- State governments use the statistics to project tax revenues and the need for public services.

- Academic regional economists use the statistics for applied research.

- Businesses, trade associations, and labor organizations use the statistics for market research.

BEA's national, international, regional, and industry estimates; the Survey of Current Business; and BEA news releases are available without charge on BEA's Web site at www.bea.gov. By visiting the site, you can also subscribe to receive free e-mail summaries of BEA releases and announcements.

****

Next state personal income release – December 19, 2013, at 8:30 A.M. for state personal income, third quarter 2013.