News Release

State Quarterly Personal Income, 1st quarter 2014-3rd quarter 2014

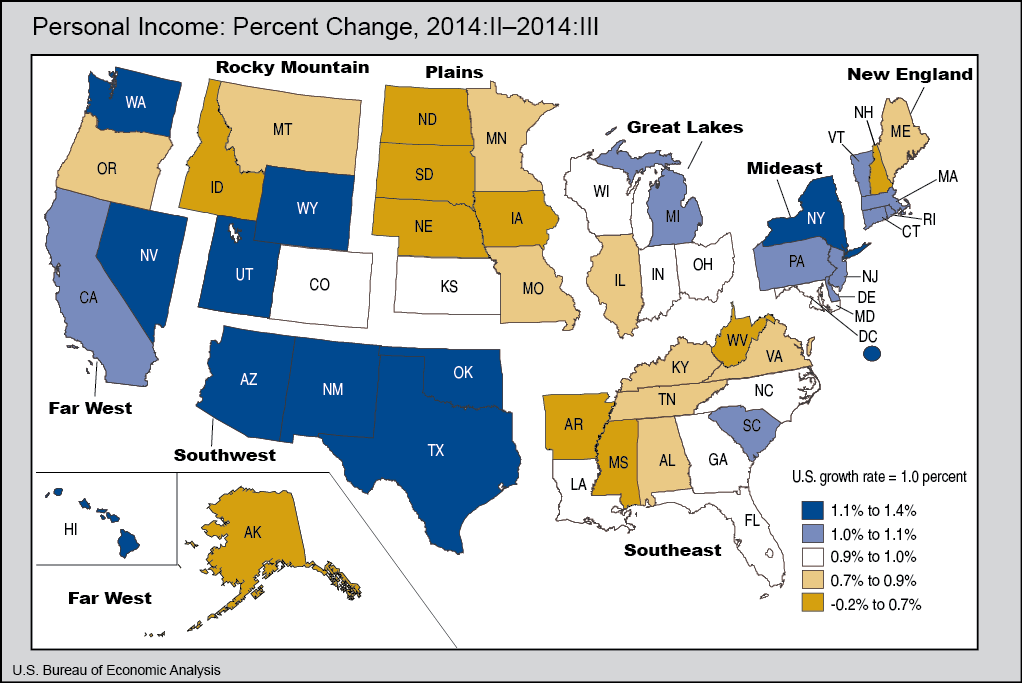

State personal income growth averaged 1.0 percent in the third quarter of 2014, down from 1.2 percent in the second quarter, according to estimates released today by the U.S. Bureau of Economic Analysis. Growth in personal income–the sum of net earnings by place of residence, property income, and personal current transfer receipts–slowed in 38 states and in the District of Columbia. The percent change across states ranged from -0.2 percent in South Dakota (the only state with a decline) to 1.4 percent in Texas. Inflation, as measured by the national price index for personal consumption expenditures, slowed to 0.3 percent in the third quarter from 0.6 percent in the second quarter.

The slowdown in personal income growth in most states is primarily accounted for by smaller increases in net earnings and property income (dividends, interest, and rent) in the third quarter of 2014. Increases in personal current transfer receipts were also smaller in most states.

Earnings by state and industry. Overall, earnings grew $85.8 billion in the third quarter after growing $97.9 billion in the second quarter. Earnings grew in 21 of the 24 industries for which BEA prepares quarterly estimates, but farm earnings fell $10.2 billion, military earnings fell $1.2 billion, and forestry earnings fell $0.1 billion.

Healthcare earnings growth in the third quarter exceeded that of all other industries in 19 states, including New York, where earnings increased $1.1 billion, and Florida, where earnings increased $0.6 billion. Healthcare also contributed the most ($12.3 billion) to national earnings growth.

In California and 8 other states, as well as in the District of Columbia, third-quarter earnings growth was the largest in the professional services industry. It was second-largest for the nation, increasing $12.0 billion.

In Louisiana and three other states, construction earnings contributed the most to third-quarter earnings growth. Construction earnings in Louisiana accounted for 9.5 percent of total earnings in the state, the highest share since at least the first quarter of 1998. Construction earnings growth ranked third for the U.S., increasing $8.5 billion. However, construction accounted for only 5.7 percent of earnings nationally, down from an average of 6.2 percent since 1998.

In Alaska, North Dakota, Oklahoma, Texas, and Wyoming, the mining industry (which includes oil and gas extraction) contributed the most to third-quarter earnings growth. North Dakota, Oklahoma, and Texas have been the 3 fastest growing states, as measured by percent growth of earnings, since the recession troughed in the second quarter of 2009.

Earnings growth in the durable-goods manufacturing industry in the third quarter exceeded that of all other industries in Indiana and Michigan. The earnings increases, $358 million in Indiana and $300 million in Michigan, were exceeded only by the $404 million increase in California.

The state of Washington had the fastest growth in information earnings of all states in the third quarter (5.5 percent). Over the last decade, information services has expanded relative to other industries in Washington and by the third quarter of 2014 accounted for 7.9 percent of all earnings (up from 5.6 percent in the third quarter of 2004). By comparison, information's share of earnings fell slightly to 3.3 percent from 3.4 percent for the U.S. over the same period.

Revisions. Estimates for 2014:I and 2014:II have been revised. All of the regional statistics underlying this news release, along with mapping and charting applications, are available at /regional/.

NOTE.—Quarter-to-quarter percent changes are calculated from unrounded data and are not annualized. Quarterly estimates are expressed at seasonally adjusted annual rates, unless otherwise specified. Quarter-to-quarter dollar changes are differences between published estimates.

Definitions

Personal income is the income received by all persons from all sources. Personal income is the sum of net earnings by place of residence, property income, and personal current transfer receipts. Property income is rental income of persons, personal dividend income, and personal interest income. Net earnings is earnings by place of work (the sum of wages and salaries, supplements to wages and salaries, and proprietors' income) less contributions for government social insurance, plus an adjustment to convert earnings by place of work to a place-of-residence basis. Personal income is measured before the deduction of personal income taxes and other personal taxes and is reported in current dollars (no adjustment is made for price changes).

The estimate of personal income in the United States is derived as the sum of the state estimates and the estimate for the District of Columbia; it differs from the estimate of personal income in the national income and product accounts (NIPAs) because of differences in coverage, in the methodologies used to prepare the estimates, and in the timing of the availability of source data.

BEA Regions

BEA groups all 50 states and the District of Columbia into eight distinct regions for purposes of data collecting and analyses: New England (Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island, and Vermont); Mideast (Delaware, District of Columbia, Maryland, New Jersey, New York, and Pennsylvania); Great Lakes (Illinois, Indiana, Michigan, Ohio, and Wisconsin); Plains (Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota, and South Dakota); Southeast (Alabama, Arkansas, Florida, Georgia, Kentucky, Louisiana, Mississippi, North Carolina, South Carolina, Tennessee, Virginia, and West Virginia); Southwest (Arizona, New Mexico, Oklahoma, and Texas); Rocky Mountain (Colorado, Idaho, Montana, Utah, and Wyoming); and Far West (Alaska, California, Hawaii, Nevada, Oregon, and Washington).

Use of State Personal Income Statistics

State personal income statistics provide a framework for analyzing current economic conditions in each state and can serve as a basis for decision making. For example:

- Federal government agencies use the statistics as a basis for allocating funds and determining matching grants to states. The statistics are also used in forecasting models to project energy and water use.

- State governments use the statistics to project tax revenues and the need for public services.

- Academic regional economists use the statistics for applied research.

- Businesses, trade associations, and labor organizations use the statistics for market research.

Resources

BEA's national, international, regional, and industry estimates; the Survey of Current Business; and BEA news releases are available without charge on BEA's Web site at www.bea.gov. By visiting the site, you can also subscribe to receive free e-mail summaries of BEA releases and announcements.

****

Next quarterly state personal income release – March 25, 2015, at 8:30 A.M. for state personal income, fourth quarter 2014 and preliminary annual 2014.