News Release

State Quarterly Personal Income, 1st quarter 2015 - 4th quarter 2015; State Annual Personal Income, 2015 (preliminary estimate)

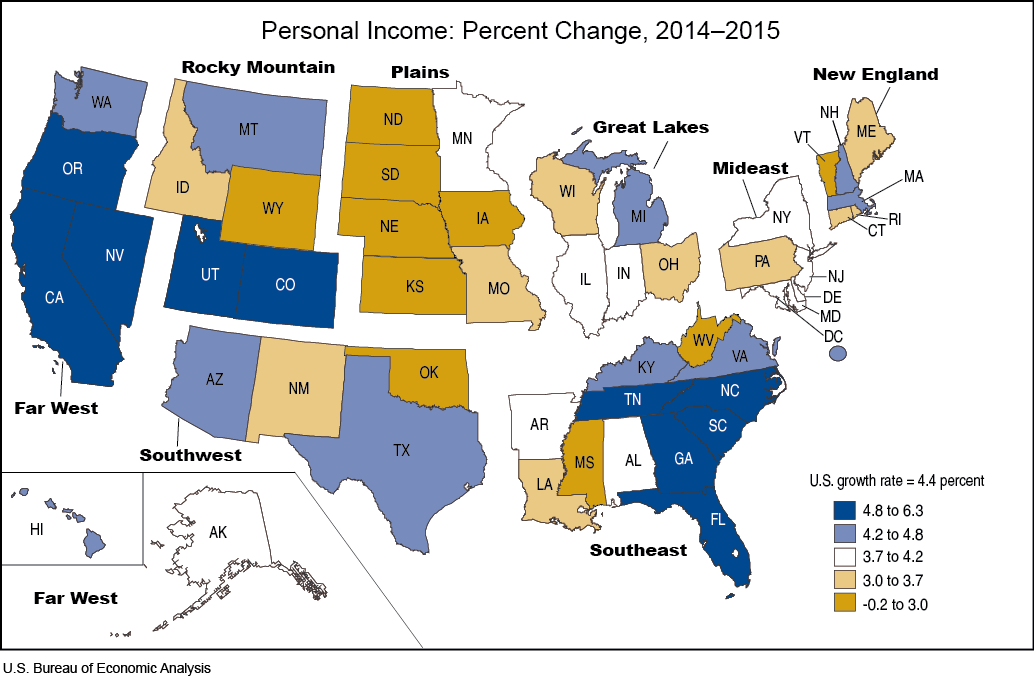

State personal income grew on average 4.4 percent in 2015, the same rate as in 2014, according to estimates released today by the U.S. Bureau of Economic Analysis. Growth of state personal income—the sum of net earnings by place of residence, property income, and personal current transfer receipts—ranged from -0.2 percent in North Dakota to 6.3 percent in California (table 1).

Net earnings. Net earnings grew 4.2 percent on average in 2015, down from 4.6 percent in 2014 (table 2). Earnings grew in 21 of the 24 industries for which BEA prepares estimates, with professional and business services, healthcare, and construction contributing the most to overall income growth in 2015 (table 3). Construction earnings increased for the fifth consecutive year and is now higher than its previous peak before the Great Recession. Earnings in mining and farming, however, fell due to declines in global prices for energy and agricultural commodities.

The percent change in net earnings in 2015 ranged from 2.8 percent in North Dakota to 6.5 percent in California (table 5).

- Earnings in professional services grew 6.6 percent nationally, and was the leading contributor to the growth in personal income in five of the fastest growing states: California, Georgia, Colorado, North Carolina, and Tennessee.

- Earnings in healthcare grew 4.5 percent nationally, and was the leading contributor to the growth in personal income in two of the fastest growing states: Oregon and Florida.

- Earnings in construction grew 8.5 percent nationally, and was the leading contributor to the growth in personal income in two of the fastest growing states: Utah and Nevada.

- Earnings in mining declined 5.2 percent nationally, and subtracted more than any other industry from the growth in personal income in four of the slowest growing states: North Dakota, Wyoming, West Virginia, and Oklahoma.

- Earnings in farming declined 21.9 percent nationally, and subtracted more than any other industry from the growth in personal income in three of the slowest growing states: South Dakota, Iowa, and Nebraska.

Property income. Property income (dividends, interest, and rent) grew 4.0 percent on average in 2015, the same as in 2014. Dividend income increased 6.5 percent in 2015, up from 3.4 percent in 2014. Growth in interest and rental income, in contrast, slowed to 0.8 percent and 7.5 percent in 2015, down from 2.4 percent and 8.4 percent, respectively in 2014. The growth in property income ranged from 3.4 percent in South Dakota to 5.4 percent in Wyoming.

Personal current transfer receipts. Personal current transfer receipts grew 5.3 percent on average in 2015, up from 4.2 percent in 2014. Medicaid benefits grew 9.8 percent, Social Security grew 4.5 percent, and Medicare grew 3.7 percent. State unemployment insurance compensation, in contrast, fell 6.6 percent. The growth in personal current transfer receipts ranged from 2.1 percent in the District of Columbia to 8.5 percent in Nevada.

Fourth quarter personal income. State personal income grew 0.8 percent on average in the fourth quarter of 2015, down from 1.0 percent in the third quarter. Thirty-three states, including the four largest, California, Texas, Florida, and New York had slower growth in personal income in the fourth quarter than in the third quarter. Growth rates ranged from -0.1 percent in Wyoming, Oklahoma, and Nebraska to 1.3 percent in Michigan (table 6). Growth in Michigan, and eight other states (Missouri, Kentucky, Ohio, Illinois, Texas, Indiana, Kansas, and Tennessee) was boosted by bonuses paid to workers represented by the United Auto Workers for ratifying new contracts.

Revisions. Today, BEA also released revised quarterly personal income estimates for 2015:I to 2015:III. Revisions were made to incorporate source data that are more complete and more detailed than previously available, and to align the states with revised national estimates.

****

Next quarterly state personal income release – June 22, 2016, at 8:30 A.M. for first quarter 2016.