News Release

Real Personal Income by State and Metropolitan Area, 2019

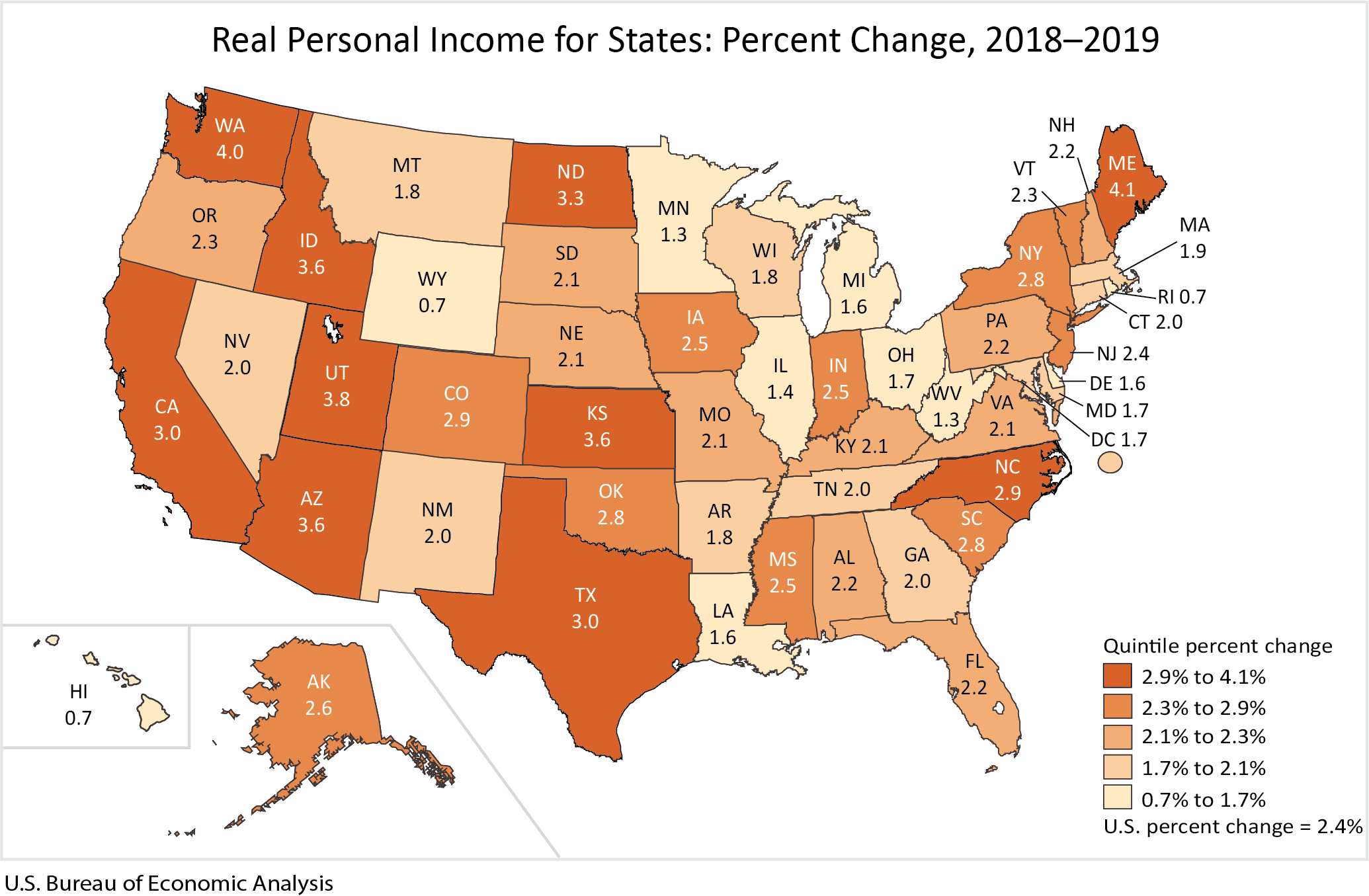

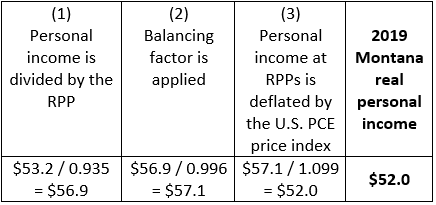

Real state personal income grew 2.4 percent in 2019 after increasing 3.1 percent in 2018, according to estimates released today by the Bureau of Economic Analysis (BEA). Real state personal income is a state's current-dollar personal income adjusted by the state's regional price parity and the national personal consumption expenditures price index. The percent change in real state personal income ranged from 4.1 percent in Maine to 0.7 percent in Hawaii, Wyoming, and Rhode Island (table 1). Across metropolitan areas, the percent change ranged from 7.6 percent in Hanford-Corcoran, CA, to –3.2 percent in Panama City, FL, and Wheeling, WV-OH (table 4).

Real Personal Income in 2019

- States with the fastest growth in real personal income were Maine (4.1 percent), Washington (4.0 percent), and Utah (3.8 percent).

- No state had a decline in real personal income. States with the slowest growth in real personal income were Rhode Island (0.7 percent), Wyoming (0.7 percent), and Hawaii (0.7 percent).

- Large metropolitan areas—those with populations greater than two million—with the fastest growth in real personal income were Austin-Round Rock-Georgetown, TX (5.3 percent), Denver-Aurora-Lakewood, CO (4.0 percent), and Riverside-San Bernardino-Ontario, CA (3.7 percent).

- Large metropolitan areas with the slowest growth in real personal income were Miami-Fort Lauderdale-Pompano Beach, FL (1.4 percent), Chicago-Naperville-Elgin, IL-IN-WI (1.4 percent), and Detroit-Warren-Dearborn, MI (1.4 percent).

Regional Price Parities in 2019

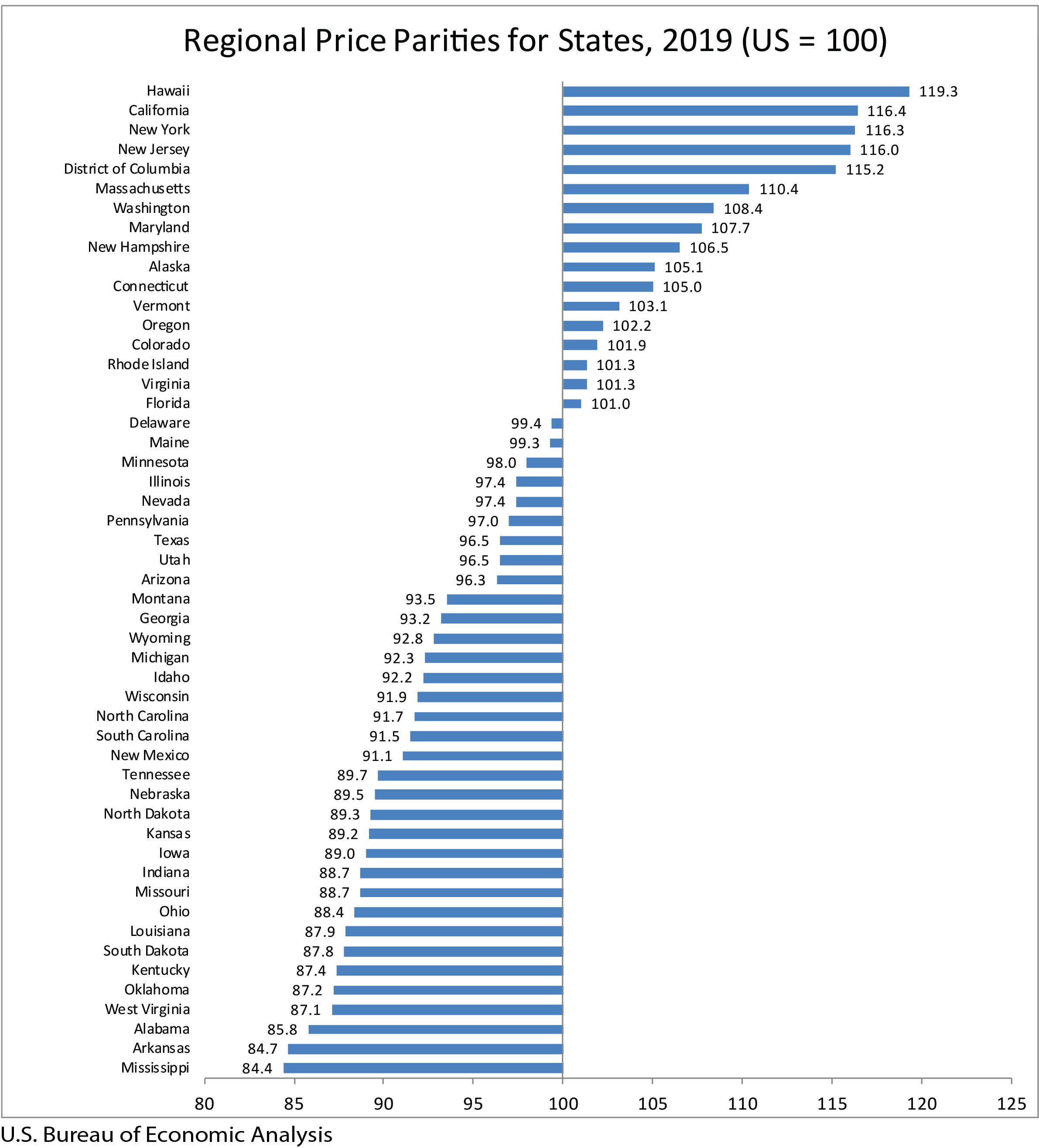

Regional price parities (RPPs) measure the differences in price levels across states and metropolitan areas for a given year and are expressed as a percentage of the overall national price level. The all items RPP covers all consumption goods and services, including housing rents. Areas with high/low RPPs typically correspond to areas with high/low price levels for rents.

- States with the highest RPPs were Hawaii (119.3), California (116.4), and New York (116.3) (table 3).

- States with the lowest RPPs were Mississippi (84.4), Arkansas (84.7), and Alabama (85.8).

- Across states, California had the highest RPP for housing rents (153.6), and Mississippi had the lowest (60.0).

- Large metropolitan areas with the highest RPPs were San Francisco-Oakland-Berkeley, CA (134.5), New York-Newark-Jersey City, NY-NJ-PA (125.7), and Los Angeles-Long Beach-Anaheim, CA (118.8) (table 6).

- Large metropolitan areas with the lowest RPPs were Cleveland-Elyria, OH (89.9), St. Louis, MO-IL (90.1), and Cincinnati, OH-KY-IN (90.6).

- Across large metropolitan areas, San Francisco-Oakland-Berkeley, CA, had the highest RPP for housing rents (200.3), and Cleveland-Elyria, OH, had the lowest (76.3).

- Across all metropolitan areas, San Jose-Sunnyvale-Santa Clara, CA, had the highest RPP for housing rents (224.0), and Beckley, WV, had the lowest (44.0).

Estimates of real personal income and regional price parities for state metropolitan and nonmetropolitan portions can be found at https://apps.bea.gov/itable/index.cfm. Supplemental tables are available upon request.

Acceleration of Release of Real Personal Income by State and Metropolitan Area

Today's release of real personal income by state and metropolitan area for 2019 represents a 5-month acceleration in the release of these statistics relative to last year's release schedule.

Annual Update of Real Personal Income

The estimates of 2019 state and metropolitan area real personal income released today incorporate the results of BEA's annual update of state and metropolitan area real personal income, also released today. The annual estimates for 2017 and 2018 were revised. The update incorporates revised source data that are more complete and more detailed than previously available.

Release of Real Personal Consumption Expenditures by State

On December 14, 2021, BEA will for the first time release official statistics of real personal consumption expenditures. These data will be combined with statistics on real personal income by state and metropolitan area in a single release for 2020.

Next release: December 14, 2021, at 8:30 A.M. EST

Real Personal Consumption Expenditures by State and

Real Personal Income by State and Metropolitan Area, 2020

* * *

Technical Notes on Regional Price Parities and Implicit Regional Price Deflators

Price indexes commonly measure price changes over time. The BEA personal consumption expenditures (PCE) price index and the Bureau of Labor Statistics (BLS) Consumer Price Index (CPI) are two examples. Spatial price indexes measure price level differences across regions for one time period. An example of this type of index is purchasing power parities (PPPs), which measure differences in price levels across countries for a given period, and can be used to convert estimates of per capita gross domestic product into comparable levels in a common currency. The RPPs that BEA has developed compare regions within the United States but without the need for currency conversion. An implicit regional price deflator (IRPD) can be derived by combining the RPPs and the U.S. PCE price index.

Regional price parities. The RPPs are calculated using price quotes for an array of items from the CPI, which are aggregated into broader expenditure categories (such as food, transportation, or education).1 Data on rents are obtained separately from the Census Bureau American Community Survey (ACS). The expenditure weights for each category are constructed using CPI expenditure weights, BEA personal consumption expenditures, and ACS rents expenditures.2

The broader categories and the data on rents are combined with the expenditure weights using a multilateral aggregation method that expresses a region's price level relative to the United States.3

For example, if the RPP for area A is 120 and the RPP for area B is 90, then on average, prices are 20 percent higher and 10 percent lower than the U.S. average for A and B, respectively. If the personal income for area A is $12,000 and the personal income for area B is $9,000, then RPP-adjusted incomes are $10,000 (or $12,000/1.20) and $10,000 (or $9,000/0.90) for A and B, respectively. In other words, the purchasing power of the two incomes is equivalent when adjusted by their respective RPPs.

Implicit regional price deflator. The IRPD is a regional price index derived as the product of two terms: the regional price parity and the U.S. PCE price index.

The implicit regional price deflator will equal current-dollar personal income divided by real personal income in chained dollars. The growth rate, or year-to-year change, in the IRPDs is a measure of regional inflation.4

Detailed information on the methodology used to estimate RPPs may be found on the regional methodology page of the BEA website: https://www.bea.gov/regional/methods.cfm.

1 The BEA Regional Price Parity statistics are based in part on restricted access Consumer Price Index data from the Bureau of Labor Statistics (BLS). The BEA statistics presented herein are products of BEA and not BLS.

2 To estimate RPPs, CPI price quotes are quality adjusted and pooled over 5 years. The ACS rents are also quality adjusted and are either annual for states or pooled over 3 years for metropolitan areas. The expenditure weights are specific for each year.

3 The multilateral system that is used is the Geary additive method. Any region or combination of regions may be used as the base or reference region without loss of consistency.

4 The growth rate of the implicit regional price deflators will not necessarily equal the region or metro area price deflators published by the BLS. This is because the CPI deflators are calculated directly while the IRPDs are indirect estimates, and because of differences in the source data and methodology.