Personal income increased $35.5 billion, or 0.2 percent at a monthly rate, while consumer spending increased $130.5 billion, or 0.8 percent, in August. The increase in personal income primarily reflected increases in compensation as well as government social benefits, which reflect advance Child Tax Credit payments authorized by the American Rescue Plan. In addition to presenting estimates for August 2021, these highlights provide comparisons to February 2020, the last month before the onset of the COVID19 pandemic in the United States. For more information, see Federal Recovery Programs and BEA Statistics.

Personal income for August 2021

The increase in personal income in August primarily reflected increases in compensation of employees and government social benefits.

- Within compensation, the increase was primarily in private wages and salaries, reflecting Bureau of Labor Statistics Current Employment Statistics.

- Within government social benefits, an increase in "other" social benefits, reflecting advance Child Tax Credit payments was partly offset by a decrease in unemployment insurance, reflecting decreases in payments from the Pandemic Unemployment Compensation program.

For more information on the advance Child Tax Credit payments, see the FAQ How does the Child Tax Credit provision of the American Rescue Plan Act of 2021 impact the NIPAs? on the BEA website. Additional information on factors affecting monthly personal income can be found on Effects of Selected Federal Pandemic Response Programs on Personal Income.

Consumer spending for August 2021

Current-dollar consumer spending increased in August, reflecting increases in goods and services.

- Within goods, nondurable goods increased, led by food and beverages as well as “other” nondurable goods (mainly, household supplies and recreational items), based on data from the Census Monthly Retail Trade Survey. Spending for durable goods decreased, led by motor vehicles and parts, based on Wards Intelligence.

- The increase in services was widespread, led by “other” services (notably, personal care and clothing services), housing and utilities, and health care.

Consumer prices for August 2021

The personal consumption expenditures price index for August increased 4.3 percent from one year ago, reflecting increases in both goods and services. Energy prices increased 24.9 percent while food prices increased 2.8 percent. Excluding food and energy, the PCE price index for August increased 3.6 percent from one year ago.

Compared to July 2021, the PCE price index increased 0.4 percent, reflecting increases in both goods and services. Energy prices increased 1.9 percent while food prices increased 0.4 percent. Excluding food and energy, the PCE price index increased 0.3 percent from July 2021 to August 2021.

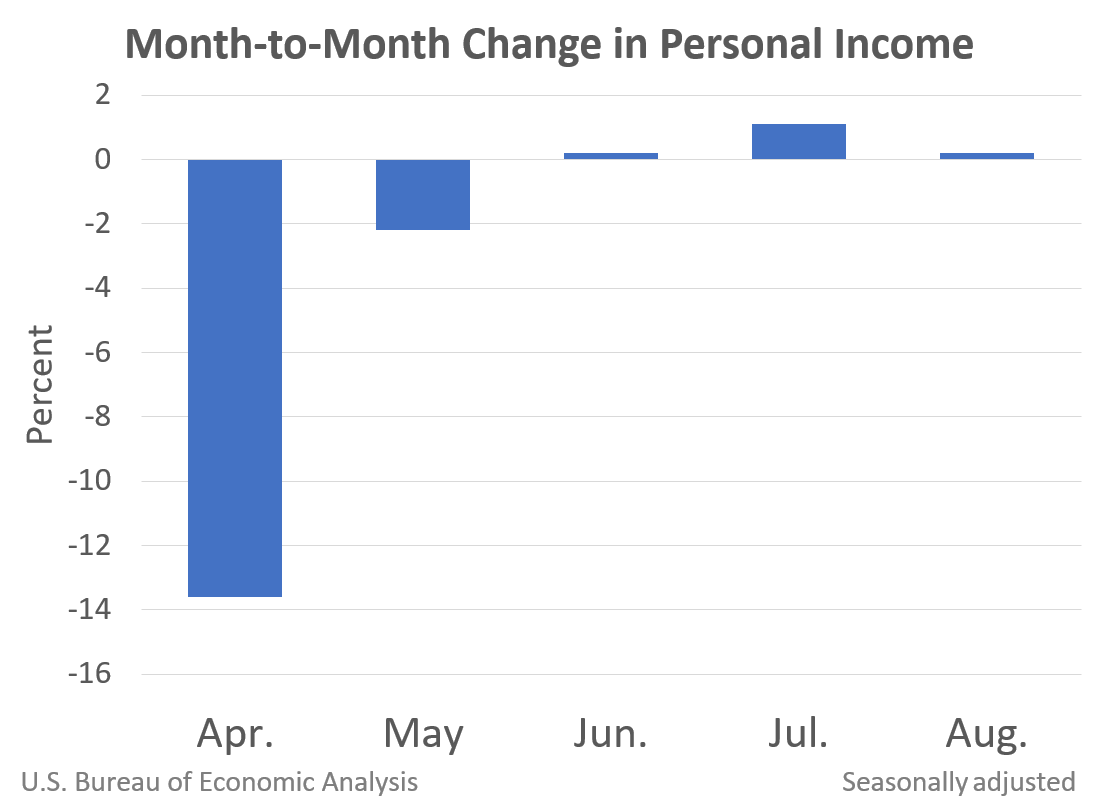

Personal income changes since February 2020

Over the past 18 months, changes in personal income primarily reflected changes in government social benefits, stemming from the enactment and expiration of legislative acts and related programs.

Consumer spending comparisons to February 2020

A comparison of the August 2021 current-dollar levels of consumer spending with the February 2020 pre-pandemic levels shows that spending for both goods and services increased.

Spending for goods in August 2021 was 20 percent above the February 2020 level. Categories with notable increases included recreational goods and vehicles (led by information processing equipment), furnishings and durable household equipment, as well as motor vehicles and parts.

Spending for services in August 2021 was 2 percent above the February 2020 level. Categories below their pre-pandemic levels include recreation and transportation services.

Since the onset of the pandemic, BEA has used traditional data sources along with alternative data sources, particularly payment card transactions, to estimate changes in the monthly pattern of consumer spending. Additional information is available at COVID-19 and Recovery: Estimates from Payment Card Transactions.