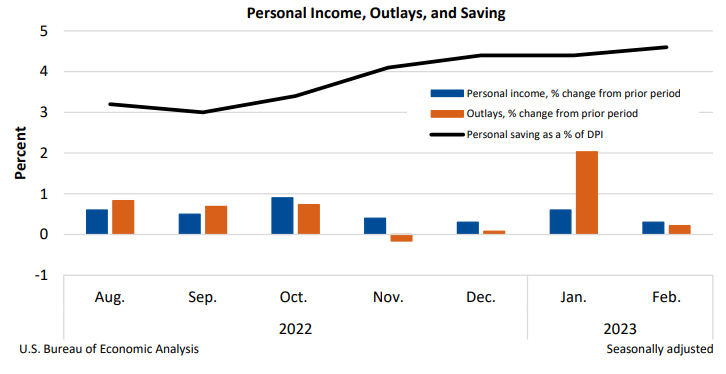

Personal income increased $72.9 billion, or 0.3 percent at a monthly rate, while consumer spending increased $27.9 billion, or 0.2 percent, in February. The increase in personal income primarily reflected an increase in compensation. The personal saving rate (that is, personal saving as a percentage of disposable personal income) was 4.6 percent in February, compared with 4.4 percent in January.

Personal income

In February, personal income increased, primarily reflecting an increase in compensation. Within compensation, the increase was led by private wages and salaries, based on data from the Bureau of Labor Statistics’ (BLS) Current Employment Statistics (CES). Within private wages and salaries, an increase of $32.4 billion in services-producing industries was partly offset by a decrease of $4.0 billion in goods-producing industries.

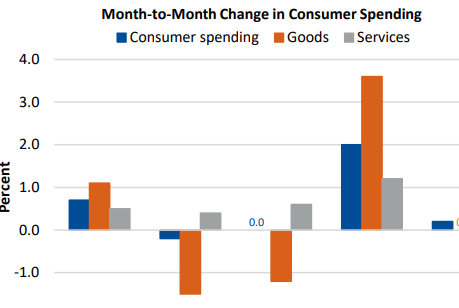

Consumer spending

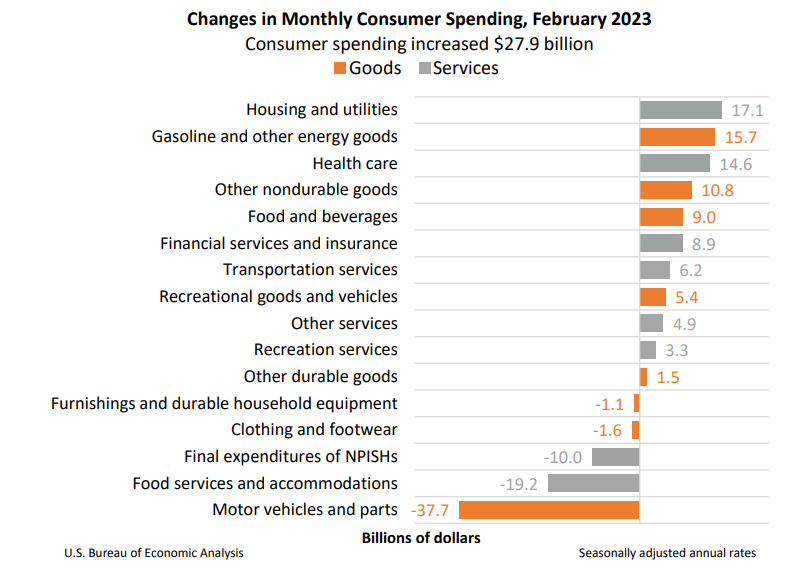

Personal outlays increased in February, primarily reflecting an increase in consumer spending for both services and goods.

- Within services, the largest contributors to the increase were housing and utilities (led by housing) and health care (led by outpatient services), based primarily on data from BLS as well as private sources. These increases were partly offset by a decrease in food services and accommodations (led by purchased meals and beverages), based on Census Bureau Monthly Retail Trade Survey (MRTS) data.

- Within goods, the largest contributors to the increase were gasoline and other energy goods (led by gasoline), based on data from the Energy Information Administration; “other” nondurable goods (led by pharmaceuticals), based primarily on Census MRTS data; and food and beverages, also based on Census MRTS data. These increases were partly offset by a decrease in motor vehicles and parts (led by new light trucks), based on unit sales data from Wards Intelligence.

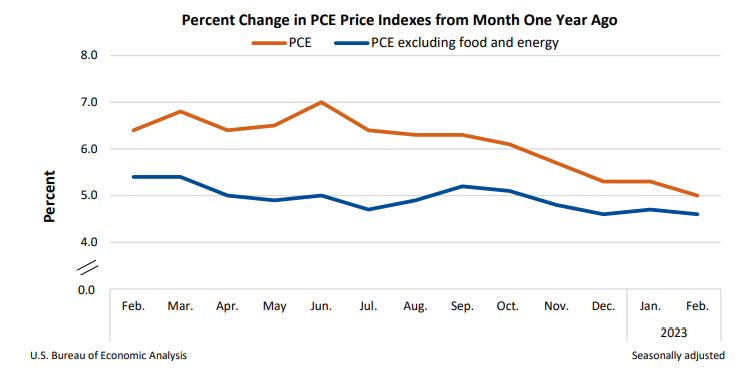

PCE price index

The personal consumption expenditures (PCE) price index for February increased 5.0 percent from one year ago, reflecting increases in both goods and services. Energy prices increased 5.1 percent while food prices increased 9.7 percent. Excluding food and energy, the PCE price index for February increased 4.6 percent from one year ago.

Compared to January, the PCE price index increased 0.3 percent. Energy prices decreased 0.4 percent and food prices increased 0.2 percent. Excluding food and energy, the PCE price index increased 0.3 percent from January to February. For a comparison of PCE prices to BLS consumer price indexes, refer to NIPA Table 9.1U. Reconciliation of Percent Change in the CPI with Percent Change in the PCE Price Index.

Real disposable personal income and consumer spending

Real disposable personal income increased 0.2 percent in February. Real consumer spending decreased 0.1 percent reflecting 0.1 percent declines in both spending on goods and spending on services. Within goods, a decrease in motor vehicles and parts was partly offset by an increase in gasoline. Within services, the largest contributor was a decrease in food services and accommodations.

For more information, read the full release.