Personal Income by State

- Interactive Tables: Personal income by state

- Interactive Maps: Personal income by state

- BEARFACTS BEA Regional Fact Sheet about personal income and gross domestic product

- Effects of Selected Federal Pandemic Response Programs on State Personal Income, 2019:Q3–2022:Q4

- Effects of Selected Federal Pandemic Response Programs on Personal Income by State, 2022

- Downloadable Data

- Data Table Availability

- Statistical Area Delineations including Metropolitan and Micropolitan Statistical Areas

- Glossary Glossary of Terms Specific to the Regional Program

- SCB, Results of the 2025 Annual Update of the Regional Economic Accounts, January 2026

- New and Updated Estimates of the Regional Economic Accounts: Results of the 2023 Comprehensive Update | SCB, December 2023

- Transactions of State and Local Government Defined Benefit Pension Plans: Experimental Estimates by State | SCB, July 2020

- Transactions of State and Local Government Defined Benefit Pension Plans: Experimental Estimates by State, Associated Tables | SCB, July 2020

- Preview of the 2021 Annual Update of the Regional Economic Accounts

- Regional Quarterly Report | SCB, March 2019

- Preview of the 2018 Comprehensive Update of the Regional Economic Accounts

- Comprehensive Revision of State Personal Income | SCB, November 2013

- An Examination of Revisions to the Quarterly Estimates of State Personal Income | SCB, August 2012

- The Reliability of the State Personal Income Estimates | SCB, December 2003

- State Retirement Income Estimates and an Alternative Measure of State Personal Income (WP2008-01) by David G. Lenze | April 2008

- Reliability of the State Personal Income Estimates | (WP2004-01) by Robert L. Brown, Bruce T. Grimm, and Marian B. Sacks

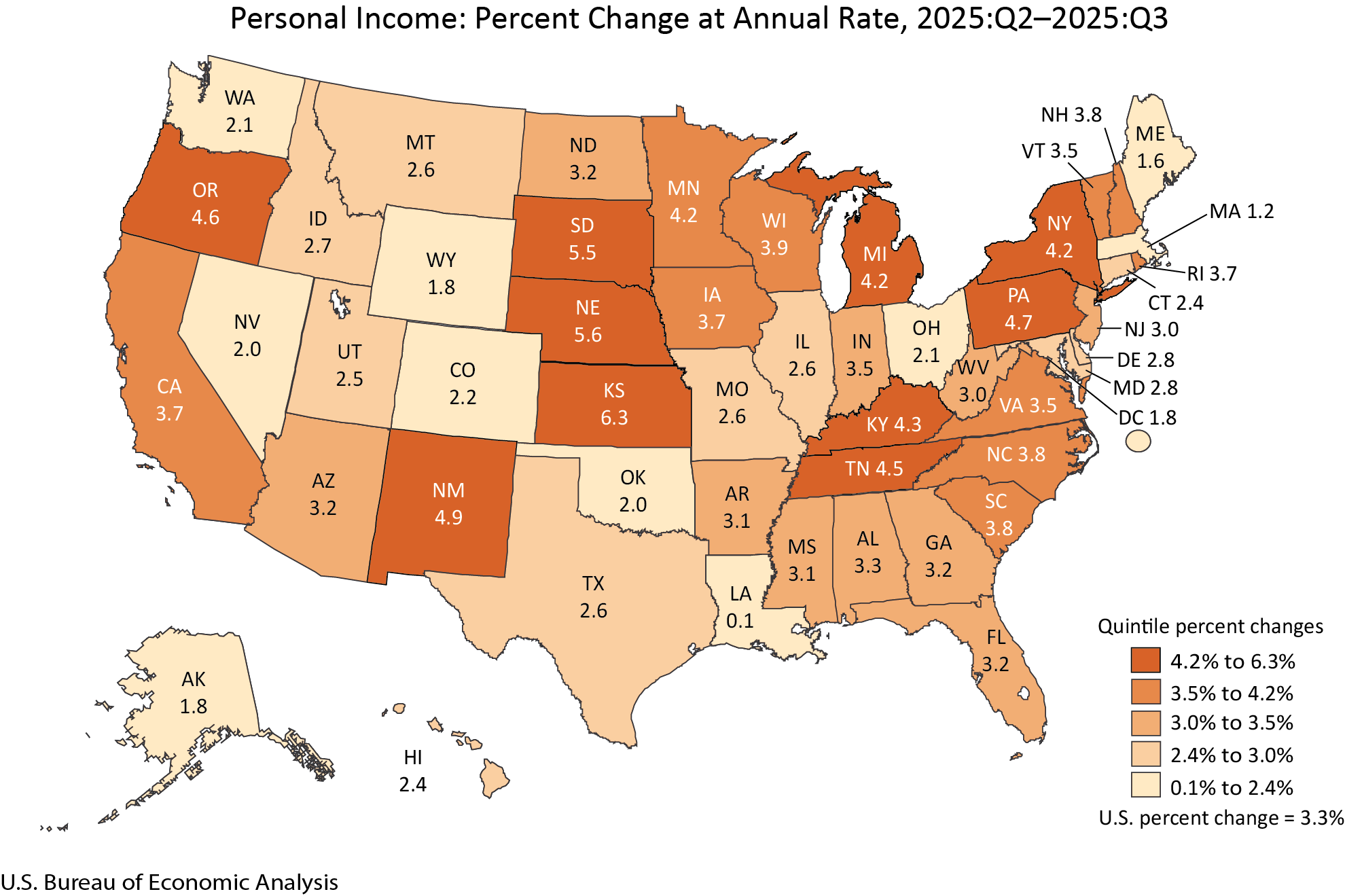

What is Personal Income by State?

The income people living in each state and the District of Columbia get from wages, proprietors' income, dividends, interest, rents, and government benefits. These statistics help assess and compare the economic well-being of state residents.

Director’s Blog: Personal Income

Contact Personnel

-

Matthew von Kerczek

-

MediaConnie O'Connell