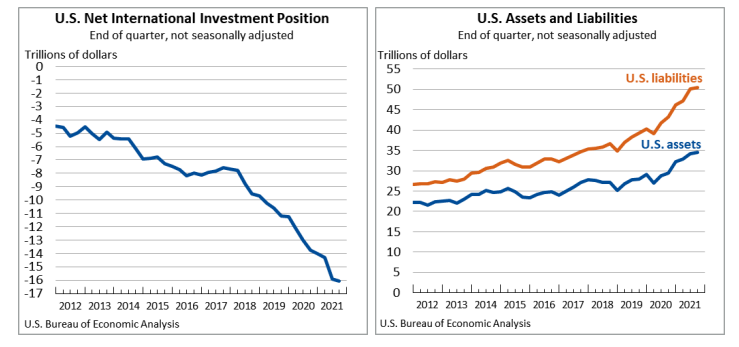

The U.S. net international investment position, the difference between U.S. residents’ foreign financial assets and liabilities, was –$16.07 trillion at the end of the third quarter of 2021, according to statistics released by the U.S. Bureau of Economic Analysis (BEA). Assets totaled $34.45 trillion, and liabilities were $50.53 trillion. At the end of the second quarter, the net investment position was –$15.91 trillion.

- The –$165.1 billion change in the net investment position from the second quarter to the third quarter came from net financial transactions of –$114.0 billion and net other changes in position, such as price and exchange-rate changes, of –$51.1 billion that mostly reflected the depreciation of major foreign currencies against the U.S. dollar that lowered the value of U.S. assets in dollar terms.

- U.S. assets increased by $181.2 billion to a total of $34.45 trillion, mostly reflecting net U.S. purchases of foreign securities and the allocation of new special drawing rights (SDRs) to the United States as its share of the general SDR allocation approved by the International Monetary Fund (IMF) in August 2021.

- U.S. liabilities increased by $346.3 billion to a total of $50.53 trillion, mostly reflecting increases in deposit liabilities and in SDR allocation liabilities that represent the U.S. long-term obligation to other IMF member countries holding SDRs.

The U.S. international investment position statistics reflect the impact of the COVID-19 pandemic and the economic recovery. The full economic effects of the pandemic cannot be separately identified in the statistics. For more information on the U.S. international investment position statistics, see U.S. International Investment Position, Third Quarter 2021.