News Release

U.S. International Investment Position, 2nd quarter 2015

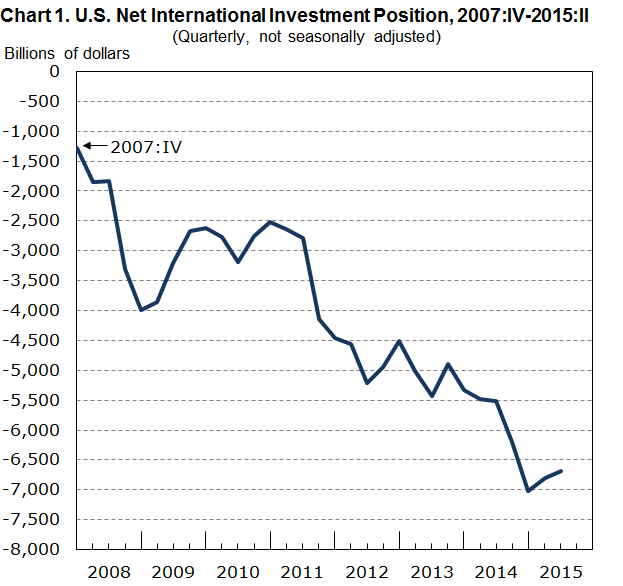

The U.S. net international investment position at the end of the second quarter of 2015 was -$6,688.3 billion (preliminary) as the value of U.S. liabilities exceeded the value of U.S. assets (chart 1, table 1). At the end of the first quarter, the net investment position was -$6,801.4 billion (revised).

Highlights

- The $113.1 billion increase in the net investment position reflected net other changes in position of $168.2 billion that were partly offset by net financial transactions of -$55.1 billion. Other changes in position include price changes, exchange-rate changes, and other changes in volume and valuation.

- U.S. assets decreased $779.3 billion and U.S. liabilities decreased $892.4 billion, mostly as a result of decreases in the value of financial derivatives.

- U.S. assets excluding financial derivatives increased $135.5 billion, reflecting financial transactions of $144.9 billion that were partly offset by other changes in position of -$9.4 billion.

- U.S. liabilities excluding financial derivatives decreased $20.2 billion, reflecting other changes in position of -$221.9 billion that were mostly offset by financial transactions of $201.7 billion.

The increase in the net investment position reflected the impact of price decreases for U.S. assets and liabilities and the appreciation of foreign currencies against the U.S. dollar, as described in greater detail below. The net investment position increased 1.7 percent in the second quarter, compared with an increase of 3.1 percent in the first quarter and an average quarterly decrease of 7.3 percent from the first quarter of 2011 through the fourth quarter of 2014. The net investment position was equal to 3.2 percent of the value of all U.S. financial assets at the end of the second quarter, down from 3.3 percent at the end of the first quarter.1

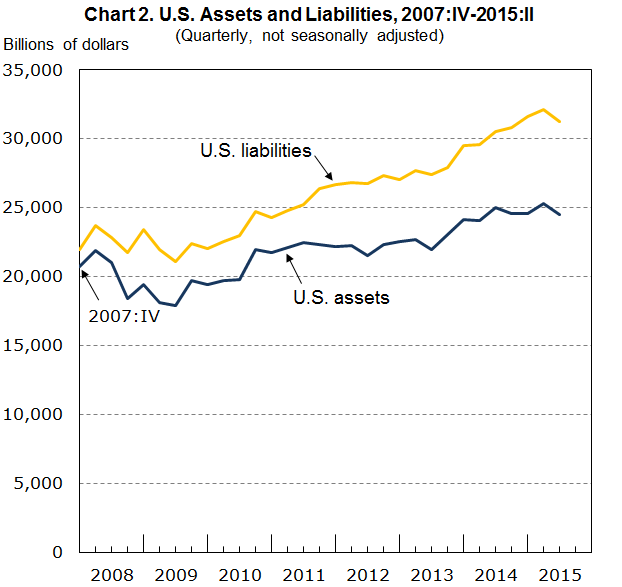

U.S. assets were $24,537.7 billion at the end of the second quarter compared with $25,317.0 billion at the end of the first quarter (chart 2). The $779.3 billion decrease reflected a $914.9 billion decrease in the value of financial derivatives that was partly offset by a $135.5 billion increase in the value of assets excluding financial derivatives.

U.S. assets excluding financial derivatives were $22,076.2 billion at the end of the second quarter compared with $21,940.7 billion at the end of the first quarter. The $135.5 billion increase reflected a $144.9 billion increase resulting from financial transactions that was partly offset by a $9.4 billion decrease resulting from other changes in position.2 Other changes in position reflected the decrease of foreign equity and bond prices that lowered the value of U.S. direct investment and portfolio investment assets. Decreases in foreign equity and bond prices were mostly offset by the appreciation of major foreign currencies against the U.S. dollar that raised the value of U.S. assets in dollar terms.3

U.S. liabilities were $31,226.0 billion at the end of the second quarter compared with $32,118.5 billion at the end of the first quarter (chart 2). The $892.4 billion decrease reflected an $872.2 billion decrease in the value of financial derivatives and a $20.2 billion decrease in the value of liabilities excluding financial derivatives.

U.S. liabilities excluding financial derivatives were $28,800.6 billion at the end of the second quarter compared with $28,820.8 billion at the end of the first quarter. The $20.2 billion decrease reflected a $221.9 billion decrease resulting from other changes in position that was mostly offset by a $201.7 billion increase resulting from financial transactions. Other changes in position were mostly attributable to decreases in U.S. bond prices that lowered the value of U.S. portfolio investment liabilities. These decreases were slightly offset by increases in the value of U.S. liabilities denominated in foreign currencies as the U.S. dollar weakened in the second quarter.

Revisions

The U.S. net international investment position at the end of the first quarter of 2015 was revised to -$6,801.4 billion from the previously-published value of -$6,794.0 billion. The $7.4 billion downward revision to the net position reflected a $7.3 billion downward revision to U.S. assets and a $0.1 billion upward revision to U.S. liabilities.

U.S. assets at the end of the first quarter were revised to $25,317.0 billion from $25,324.4 billion; U.S. liabilities were revised to $32,118.5 billion from $32,118.3 billion. These revisions reflect revised source data from the Treasury International Capital (TIC) reporting system and from BEAs quarterly surveys of direct investment.

****

NOTE: This news release is available on BEAs Web site (www.bea.gov) along with Highlights related to this release, the latest detailed statistics for the U.S. international investment position, and a description of the estimation methods used to compile them. The second-quarter statistics in this release are preliminary and will be revised on December 29, 2015.

1 Board of Governors of the Federal Reserve System (FRS), Financial Accounts of the United States, Second Quarter 2015, Z.1. Statistical Release (Washington, DC: FRS, September 18, 2015). According to the September release, the value of all U.S. financial assets was $206,473.5 billion at the end of the second quarter. The value of U.S. assets abroad was $24,537.7 billion, or 11.9 percent of all U.S. financial assets, down from 12.3 percent at the end of the first quarter.

2 For statistics on financial transactions, see the financial account in table 1.2 of the U.S. International Transactions Accounts. Quarterly financial transactions presented in this release are not seasonally adjusted. Detail on other changes in position such as price changes, exchange-rate changes, and other changes in volume and valuation is presented only for annual statistics in the June release each year.

3 According to the Federal Reserve Board's major currencies index, foreign currencies appreciated 2.4 percent against the U.S. dollar from the end of the first quarter to the end of the second quarter. The major currencies index is a weighted average of the foreign exchange values of the U.S. dollar against a subset of the broad index currencies that circulate widely outside the country of issue. See Foreign Exchange RatesH10 (weekly release of daily data), Nominal Major Currencies Index at www.federalreserve.gov.

Release dates in 2015

| End of the Fourth Quarter and Year 2014 | March 31, 2015 (Tuesday) |

| End of the First Quarter of 2015, Year 2014, and Annual Revisions | June 30, 2015 (Tuesday) |

| End of the Second Quarter of 2015 | September 29, 2015 (Tuesday) |

| End of the Third Quarter of 2015 | December 29, 2015 (Tuesday) |

BEA statistics—including GDP, personal income, the balance of payments, foreign direct investment, the input-output accounts, and economic statistics for states, local areas, and industries—are available on the BEA Web site: www.bea.gov. E-mail alerts are also available.