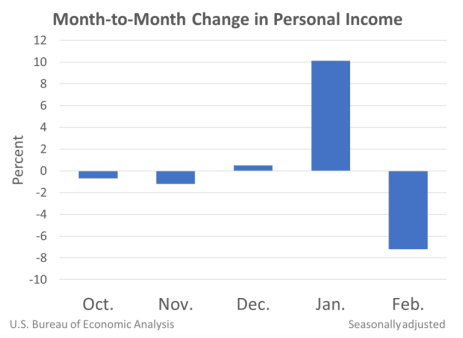

Personal income decreased $1,516.6 billion, or 7.1 percent at a monthly rate, while consumer spending decreased $149.0 billion, or 1.0 percent, in February. Economic impact payments associated with the Coronavirus Response and Relief Supplemental Appropriations (CRRSA) Act of 2021 (which was enacted on December 27, 2020) declined sharply in February and unemployment benefits continued, but at a lower level. In addition to presenting estimates for February 2021, these highlights provide comparisons to February 2020, the last month before the onset of the COVID-19 pandemic in the United States.

Personal income for February 2021

The decrease in personal income in February was more than accounted for by a decrease in government social benefits. Within government social benefits, “other” social benefits, specifically the economic impact payments to households, decreased. The CRRSA Act authorized an additional round of economic impact payments, which were mostly distributed in January. Additional information on factors affecting monthly personal income can be found on “Effects of Selected Federal Pandemic Response Programs on Personal Income.”

Consumer spending for February 2021

Current-dollar consumer spending decreased in February, which was more than accounted for by a decrease in goods. Services increased.

- Within goods, both durable goods (led by recreational goods and vehicles, notably information processing equipment) and nondurable goods (led by “other” nondurable goods, which includes items like pharmaceutical products) contributed to the decrease, largely based on data from the Census Monthly Retail Trade Survey.

- Within services, the increase was led by housing and utilities (notably, electricity and gas), based on data from the Energy Information Administration. Spending for health care (led by outpatient services) also increased, reflecting data on the volume of visits as well as revenue data.

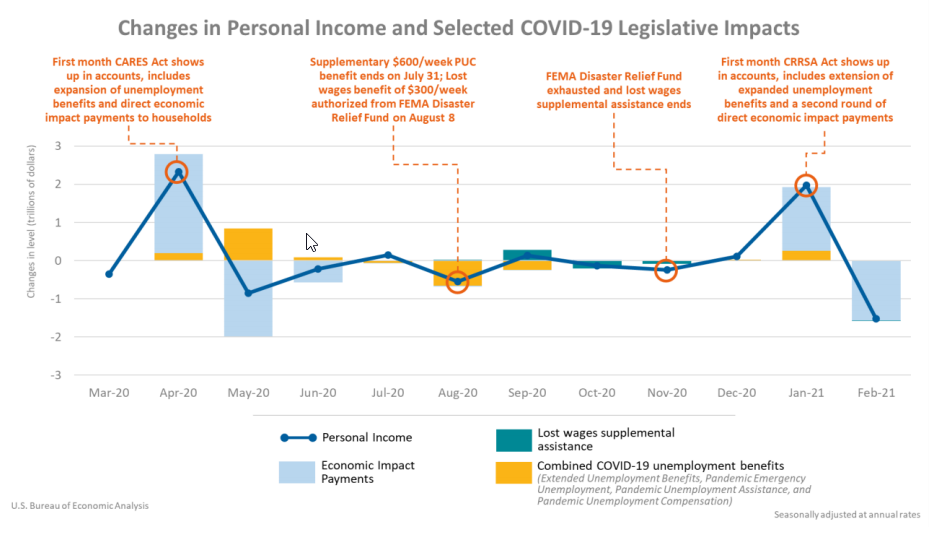

Personal income comparisons to February 2020

Over the past 12 months, changes in personal income reflected changes in government social benefits, which were based on the enactment and expiration of various legislative acts and related programs.

Both the CARES Act and CRRSA Act included expansions of unemployment insurance programs. Under the Pandemic Unemployment Compensation program, both Acts provided supplementary weekly payments to those receiving unemployment benefits. Information on specific unemployment programs and their provisions can be found at “How will the expansion of unemployment benefits in response to the COVID-19 pandemic be recorded in the NIPAs?”

Additionally, both acts provided direct economic impact payments to households. The CARES Act provided $1,200 for each qualified individual and qualified taxpayers with children received $500 for each child. The CRRSA Act provided $600 for each qualified individual and child, and payments were distributed mostly in January 2021. For additional information, see “How are federal economic impact payments to support individuals during the COVID-19 pandemic recorded in the NIPAs?”

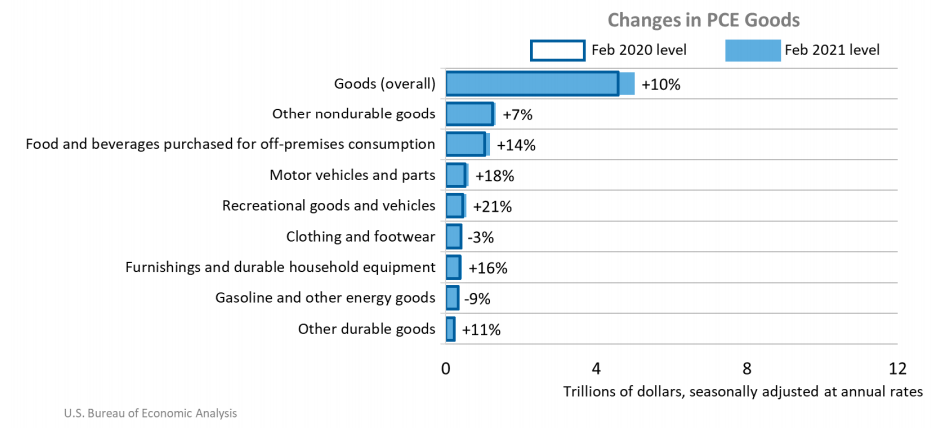

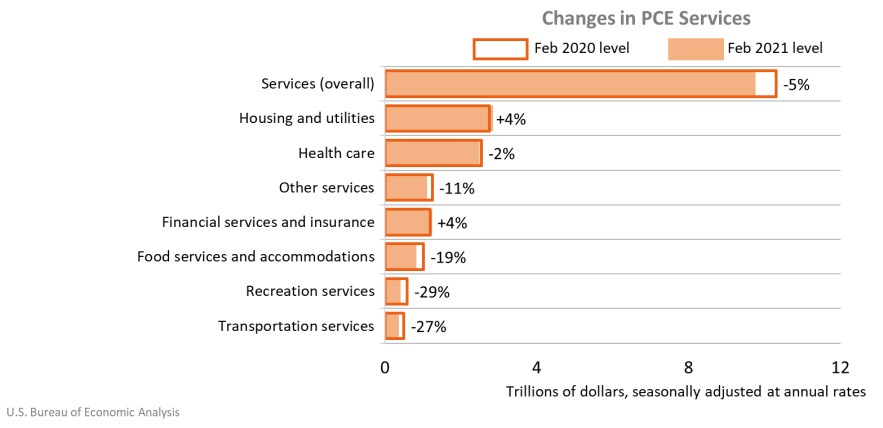

Consumer spending comparisons to February 2020

A comparison of the February 2021 current-dollar levels of consumer spending with the February 2020 pre-pandemic levels shows that spending for goods increased while spending for services decreased.

Spending for goods in February 2021 was 10 percent above the February 2020 level. Categories with notable increases included food and beverages, motor vehicles and parts, and recreational goods and vehicles (led by information processing equipment).

Spending for services in February 2021 was 5 percent below the February 2020 level. Categories with notable decreases included food services and accommodations, recreation services, and transportation services. During the COVID-19 pandemic, establishments in these sectors were at times closed or at limited capacity.

Since the onset of the pandemic, BEA used traditional data sources along with alternative data sources, particularly payment card transactions, to estimate the sudden changes in the monthly pattern of consumer spending. Additional information is available at “COVID-19 and Recovery: Estimates from Payment Card Transactions.”

For more information, read the full report.