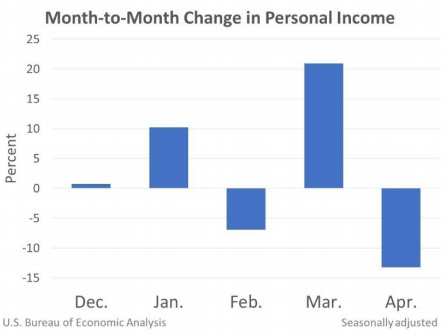

Personal income decreased $3.21 trillion, or 13.1 percent at a monthly rate, while consumer spending increased $80.3 billion, or 0.5 percent, in April. Economic impact payments established by the American Rescue Plan Act, declined sharply in April. In addition to presenting estimates for April 2021, these highlights provide comparisons to February 2020, the last month before the onset of the COVID-19 pandemic in the United States. For more information, see Federal Recovery Programs and BEA Statistics.

Personal income for April 2021

The decrease in personal income in April primarily reflected a decrease in government social benefits. Within government social benefits, “other” social benefits, specifically the economic impact payments to households, decreased. Unemployment insurance also decreased, led by decreases in payments from the Pandemic Unemployment Compensation program. Additional information on factors affecting monthly personal income can be found on Effects of Selected Federal Pandemic Response Programs on Personal Income.

Consumer spending for April 2021

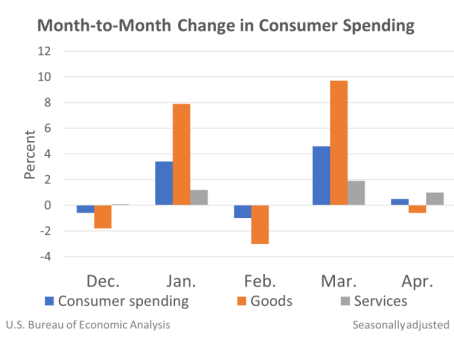

Current-dollar consumer spending increased in April, reflecting an increase in services that was partly offset by a decrease in goods.

- Within goods, a decrease in nondurable goods (led by food and beverages), based on data from the Census Monthly Retail Trade Survey (MRTS), was partly offset by an increase in durable goods(led by motor vehicles and parts), based on data from Wards Automotive.

- Within services, the increase was led by recreation services (led by membership clubs, sports centers, parks, theaters, and museums), based on payment card transaction data, as well as food services and accommodations(led by food services), based on data from MRTS.

Consumer prices for April 2021

The personal consumption expenditures (PCE) price index increased 3.6 percent in April from one year ago, reflecting increases in both goods and services. Energy prices increased 24.8 percent while food prices increased 0.9 percent. Excluding food and energy, the PCE price index increased 3.1 percent in April from one year ago.

Personal income comparisons to February 2020

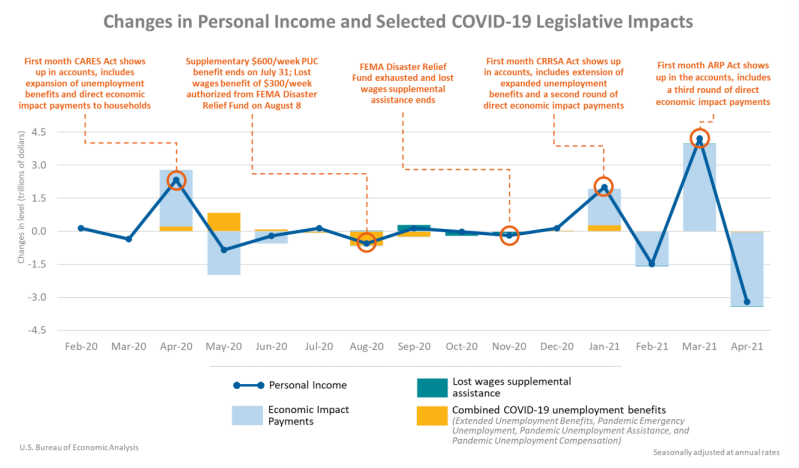

Over the past 14 months, changes in personal income primarily reflected changes in government social benefits, which were based on the enactment and expiration of legislative acts and related programs.

The Coronavirus Aid, Relief, and Economic Security Act, the Coronavirus Response and Relief Supplemental Appropriations Act, and the American Rescue Plan Act provided direct economic impact payments to households. The ARP Act provided up to $1,400 for qualified individuals. Payments were distributed mostly in March 2021. For additional information, see How are federal economic impact payments to support individuals during the COVID-19 pandemic recorded in the NIPAs?

Consumer spending comparisons to February 2020

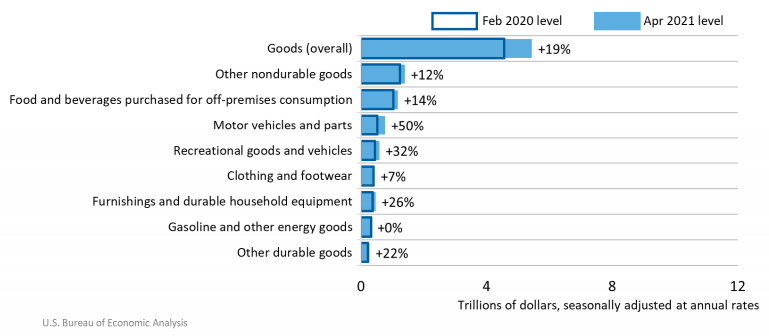

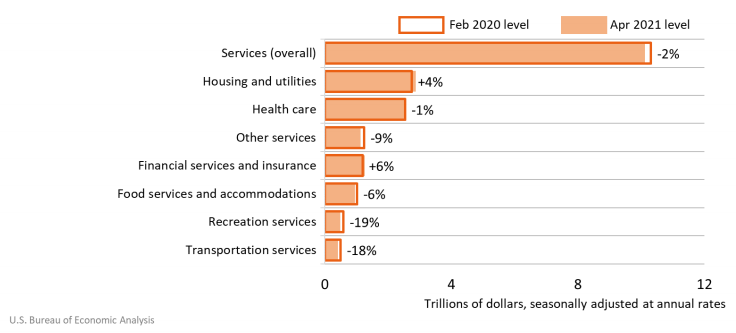

A comparison of the April 2021 current-dollar levels of consumer spending with the February 2020 prepandemic levels shows that spending for goods increased while spending for services decreased.

Spending for goods in April 2021 was 19.0 percent above the February 2020 level. Categories with notable increases included motor vehicles and parts, recreational goods and vehicles (led by information processing equipment), and furnishings and durable household equipment.

Spending for services in April 2021 was 2.0 percent below the February 2020 level. Categories with notable decreases included transportation services, recreation services, and food services and accommodations. During the COVID-19 pandemic, establishments in these sectors were at times closed or at limited capacity.

Since the onset of the pandemic, BEA used traditional data sources along with alternative data sources, particularly payment card transactions, to estimate changes in the monthly pattern of consumer spending. Additional information is available at COVID-19 and Recovery: Estimates from Payment Card Transactions.

For more information, read the full report.