Bureau of Economic Analysis

U.S. International Investment Position, 2nd Quarter 2025

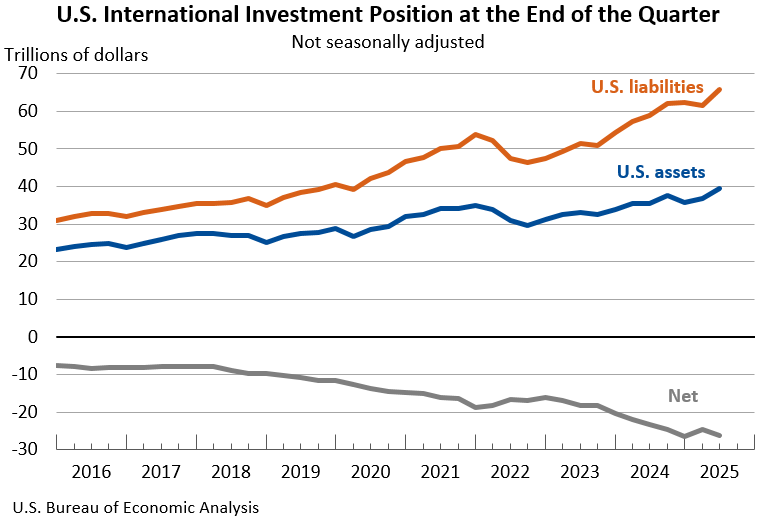

The U.S. net international investment position, the difference between U.S. residents’ foreign financial assets and liabilities, was -$26.14 trillion at the end of the second quarter of 2025, according to statistics released today by the U.S. Bureau of Economic Analysis. Assets totaled $39.56 trillion, and liabilities were $65.71 trillion. At the end of the first quarter, the net investment position was -$24.65 trillion (revised).

Principal Federal Economic Indicators

Noteworthy

The Latest

U.S. International Trade in Goods and Services, March 2016

U.S. Census Bureau U.S. Bureau of Economic Analysis NEWS U.S. Department of Commerce * Washington, DC 20230 U.S. INTERNATIONAL TRADE IN GOODS AND SERVICES March 2016 The U.S. Census Bureau and the U.S.

Personal Income Rises in March

Personal income increased 0.4 percent in March after increasing 0.1 percent in February. Wages and salaries, the largest component of personal income, increased 0.4 percent in March after decreasing 0.1 percent in February.

Personal Income and Outlays, March 2016

Personal income increased $57.4 billion, or 0.4 percent, and disposable personal income (DPI) increased $50.4 billion, or 0.4 percent, in March, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $12.8 billion, or 0.1 percent.

GDP Increases in First Quarter

Real gross domestic product (GDP) increased 0.5 percent in the first quarter of 2016, according to the “advance” estimate released today by the Bureau of Economic Analysis. In the fourth quarter of 2015, real GDP increased 1.4 percent.

Gross Domestic Product, 1st quarter 2016 (advance estimate)

Real gross domestic product -- the value of the goods and services produced by the nation's economy less the value of the goods and services used up in production, adjusted for price changes -- increased at an annual rate of 0.5 percent in the first quarter of 2016, according to the "advance" estimate released by the Bureau of Economic Analysis.

Industry in Focus: What's the Economic Impact of the Information Industry?

The Information industry, more than just about any other industry, illustrates just how much the U.S. economy has changed over time. Not all that long ago, in previously used industry classification systems, the information sector didn’t have its own category. Many of its activities fell under other industries such as manufacturing, communications, and business services, but weren’t always separately identified.

Information Services Led Growth in the Fourth Quarter

Information; construction; and professional, scientific, and technical services were the leading contributors to the increase in U.S. economic growth in the fourth quarter of 2015. Overall, 16 of 22 industry groups contributed to the 1.4 percent increase in real GDP in the fourth quarter.

Gross Domestic Product by Industry, 4th quarter and annual 2015

Information; construction; and professional, scientific, and technical services were the leading contributors to the increase in U.S. economic growth in the fourth quarter of 2015. According to statistics on the breakout of gross domestic product (GDP) by industry released today by the Bureau of Economic Analysis (BEA), overall, 16 of 22 industry groups contributed to the 1.4 percent increase in real GDP in the fourth quarter.

BEA to Host Webinar on Wednesday to Explain Change Simplifying How Private Funds Report

The Bureau of Economic Analysis and the Treasury Department are preparing to implement a change that will simplify how certain cross-border investments by or into private funds are reported on Treasury International Capital, or TIC, surveys of portfolio investment and BEA surveys of direct investment.

Statistics on Federal Refundable Tax Credits for Every State Now Available

For years, BEA has provided state-by-state information on people’s incomes, which includes refundable tax credits and rebates. But BEA did not break out the refundable tax credit statistics.

Now, for the first time, BEA is making available the amounts and types of federal refundable tax credits broken out for each state, giving policymakers, researchers and academics a new tool for economic analysis.