U.S. International Transactions, 4th Quarter and Year 2023

|

Q4 2023

|

-$194.8 B

|

|

Q3 2023

|

-$196.4 B

|

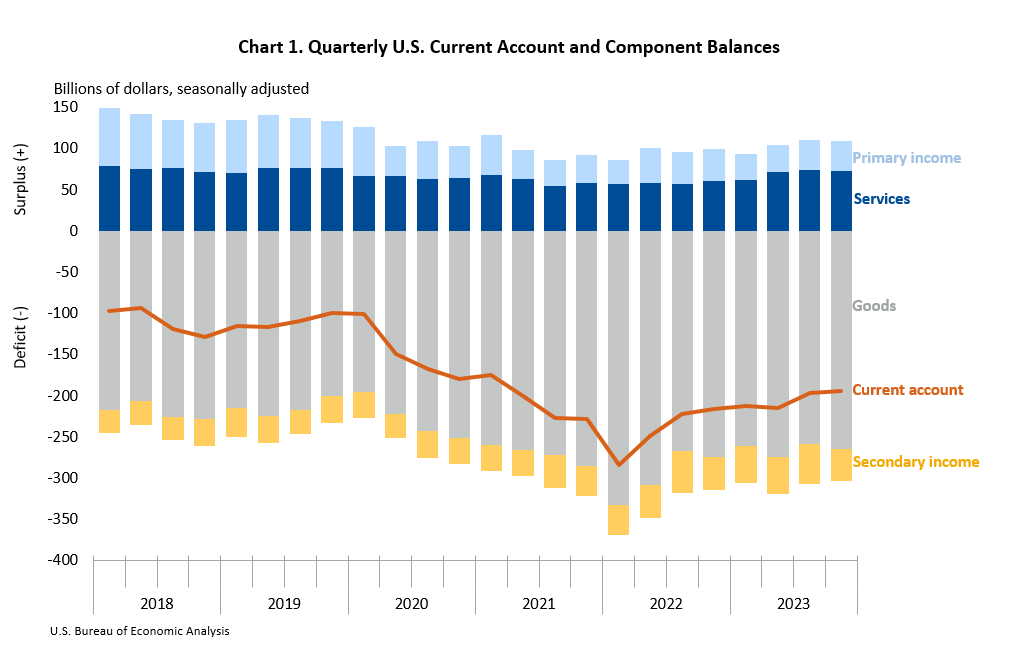

The U.S. current-account deficit narrowed by $1.6 billion, or 0.8 percent, to $194.8 billion in the fourth quarter of 2023, according to statistics released today by the U.S. Bureau of Economic Analysis. The revised third-quarter deficit was $196.4 billion. The fourth-quarter deficit was 2.8 percent of current-dollar gross domestic product, down less than 0.1 percent from the third quarter.

- Current Release: March 21, 2024

- Next Release: June 20, 2024

U.S. International Transactions, 4th Quarter and Year 2023

- U.S. Trade in Goods and Services with the European Union (27), 1999:I-2019:IV and 1999-2019

- Personal Transfers, 1992:I-1998:IV

- Personal Transfers, beginning in 1999 For statistics beginning with 1999, see Table 5.1, line 18, of the U.S. International Transactions Accounts.

- Transfers under U.S. Military Agency Sales Contracts Including All Goods and Services, 1999:I-2016:I Direct Defense Expenditures Including All Goods and Services, 1999:I-2016:I

- Revisions to U.S. Government Payments, 2009-2011

- Transactions in Long-term Securities, 1970-1981

- International: Supplemental Statistics

- International Transactions Accounts Overview

- U.S. International Economic Accounts: Concepts and Methods

- A Guide to BEA’s Services Surveys

- International Surveys: U.S. International Services Transactions

- International Surveys: U.S. Direct Investment Abroad

- International Surveys: Foreign Direct Investment in the United States

- International Surveys: Archived Survey Forms

- 2014 Comprehensive Restructuring of the U.S. International Transactions Accounts

- Industry and Foreign Trade Classification Materials

- Annual Updates of the U.S. International Transactions Accounts

- U.S. International Transactions: Third Quarter 2023

- U.S. International Transactions: Second Quarter 2023

- U.S. International Transactions: First Quarter 2023

- U.S. International Transactions: Fourth Quarter and Year 2022

- U.S. International Transactions: Third Quarter 2022

- U.S. International Transactions: Second Quarter 2022

- 2023 Annual Update of the U.S. International Transactions Accounts

- Preview of the 2023 Annual Update of the International Economic Accounts

- Data Archive Previously published estimates contain historical data and have since been revised. Please contact the International program area with questions

- News Release Archive

What are the International Transactions Accounts?

Transactions in goods, services, income, and investment between U.S. residents and residents of other countries each quarter. The transactions reflect U.S. trade; income on stocks, bonds, and loans and related investment; foreign aid; and more.

Contact Personnel

-

TechnicalElliot Berg

-

MediaConnie O’Connell