Bureau of Economic Analysis

U.S. International Transactions, 2nd Quarter 2025

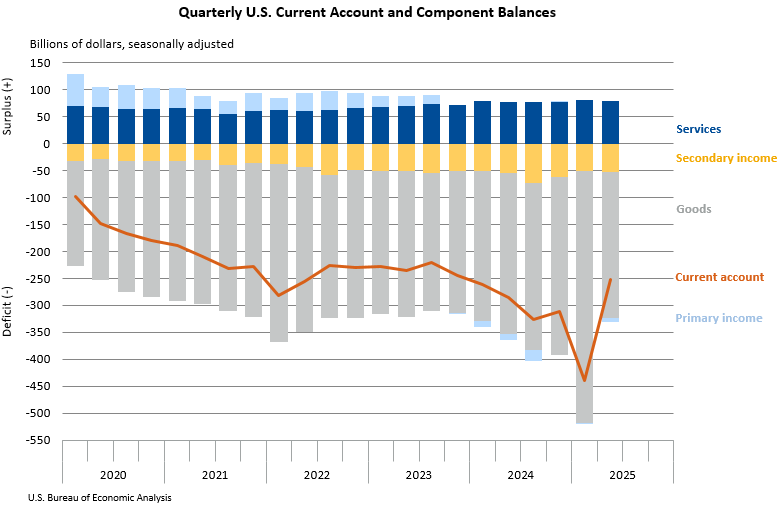

The U.S. current-account deficit narrowed by $188.5 billion, or 42.9 percent, to $251.3 billion in the second quarter of 2025, according to statistics released today by BEA. The revised first-quarter deficit was $439.8 billion. The second-quarter deficit was 3.3 percent of current-dollar gross domestic product, down from 5.9 percent in the first quarter.

Principal Federal Economic Indicators

Noteworthy

The Latest

Real Personal Income for States and Metropolitan Areas, 2007-2011 (prototype estimate)

Today, the U.S. Bureau of Economic Analysis released experimental real, or inflation-adjusted, estimates of personal income for states and metropolitan areas. The inflation-adjustments are based in part on regional price parities (RPPs) that provide a measure of differences in price levels across each state and region relative to the national price level for each of the years, 2007-2011.

Widespread State Economic Growth in 2012

Real gross domestic product (GDP) increased in 49 states and the District of Columbia in 2012. Leading industry contributors were durable-goods manufacturing, finance and insurance, and wholesale trade. Durable-goods manufacturing was the largest contributor to U.S. real GDP by state growth in 2012.

Gross Domestic Product by State, 2012 (advance estimate) and 2009-2011 (revised estimate)

EMBARGOED UNTIL RELEASE AT 8:30 A.M. EDT, THURSDAY, JUNE 6, 2013

April 2013 Trade Gap is $40.3 Billion

The U.S. monthly international trade deficit increased in April 2013 according to the U.S. Bureau of Economic Analysis and the U.S. Census Bureau. The deficit increased from $37.1 billion (revised) in March to $40.3 billion in April as imports increased more than exports. The previously published March deficit was $38.8 billion. The goods deficit increased $3.2 billion from March to $58.6 billion in April; the services surplus increased $0.1…

U.S. International Trade in Goods and Services, April 2013 U.S. International Trade in Goods and Services , 2012 annual revision

-->

Real Consumer Spending Slows Slightly

Personal income remained flat in April after increasing 0.3 percent in March. Wages and salaries, the largest component of personal income, remained flat in April after increasing 0.2 percent in March.

Current-dollar disposable personal income (DPI), after-tax income, decreased 0.1 percent in April after increasing 0.2 percent in March.

Real DPI, income adjusted for taxes and inflation, increased 0.1 percent in April after…

Personal Income and Outlays, April 2013

Personal income decreased $5.6 billion, or less than 0.1 percent, and disposable personal income (DPI) decreased $16.1 billion, or 0.1 percent, inApril, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) decreased $20.5 billion, or 0.2 percent. In March, personal income increased $36.2 billion, or 0.3 percent, DPI increased $25.4 billion, or 0.2 percent, and PCE increased $14.2 billion, or 0.1 percent, based…

GDP Growth Accelerates in First Quarter

Real gross domestic product (GDP) increased 2.4 percent in the first quarter of 2013 after increasing 0.4 percent in the fourth quarter of 2012, according to estimates released by the Bureau of Economic Analysis. The first-quarter growth rate was revised down 0.1 percentage point from the advance estimate released in April.

GDP highlights The following contributed to the acceleration in growth:

Gross Domestic Product, 1st quarter 2013 (second estimate); Corporate Profits, 1st quarter 2013 (preliminary estimate)

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 2.4 percent in the first quarter of 2013 (that is, from the fourth quarter to the first quarter), according to the "second" estimate released by the Bureau of Economic Analysis. In the fourth quarter, real GDP increased 0.4 percent. The GDP estimate released today is based…

May 31st Deadline for Returning Completed Foreign Direct Investment Surveys Draws Near

The May 31st deadline is rapidly approaching for people to return their completed BE–12 surveys to the U.S. Bureau of Economic Analysis.

These surveys are critical to BEA’s ability to produce statistics on foreign direct investment in the United States. The statistics help policymakers and the general public understand the impact of foreign investment on the U.S. economy.

Therefore, it is vitally important that you waste no…