Bureau of Economic Analysis

Gross Domestic Product by County and Personal Income by County, 2024

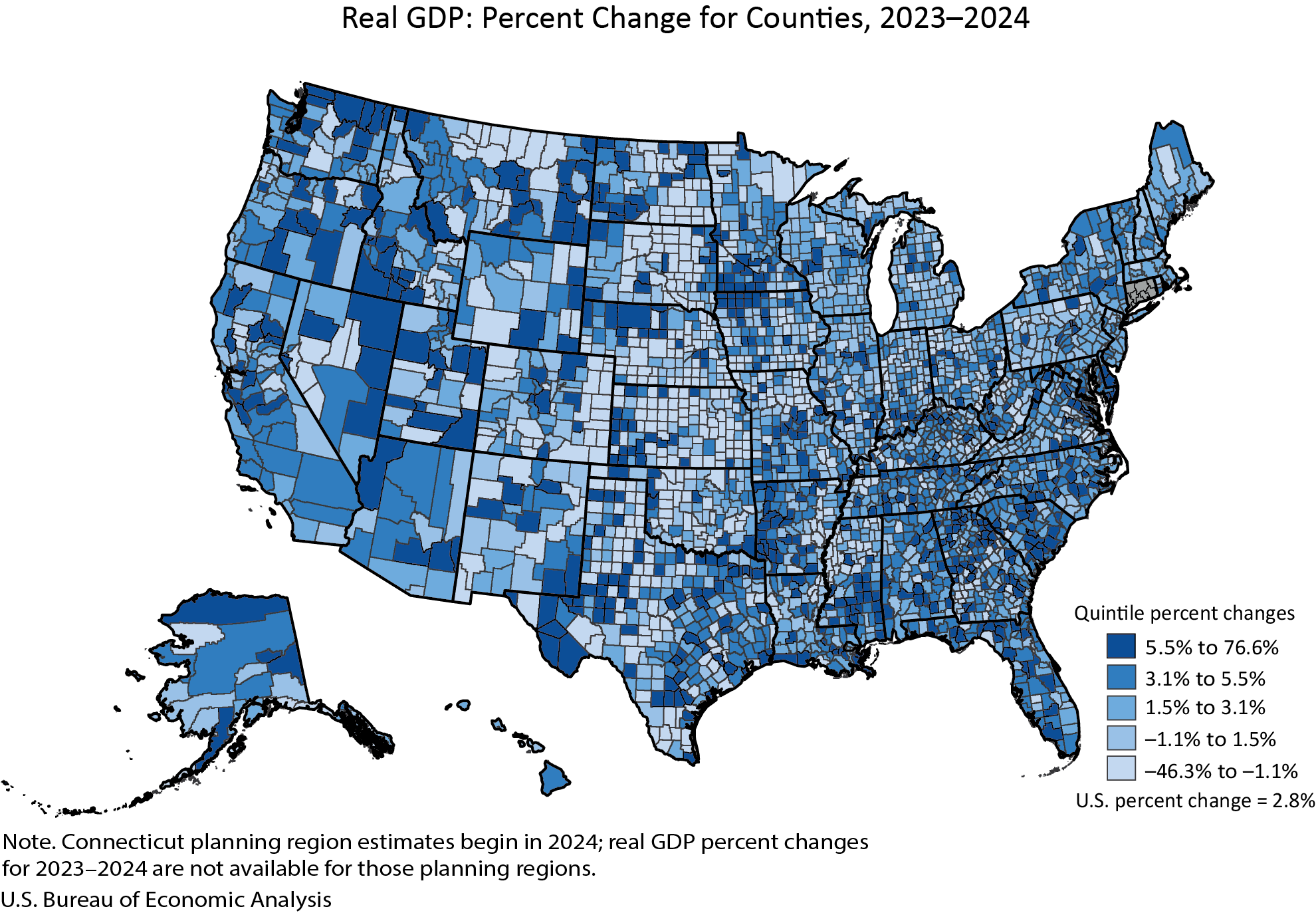

Real gross domestic product (GDP) increased in 2,273 counties, decreased in 809 counties, and was unchanged in 24 counties in 2024. County-level changes ranged from a 76.6 percent increase in Carter County, MT, to a 46.3 percent decline in Baca County, CO.

Personal income, in current dollars, increased in 2,768 counties, decreased in 331, and was unchanged in 7 counties in 2024. County-level changes ranged from a 22.6 percent increase in Harding County, SD, to a 23.3 percent decline in Issaquena County, MS.

Principal Federal Economic Indicators

Noteworthy

The Latest

Personal Income and Outlays, July 2023

Personal income increased $45.0 billion (0.2 percent at a monthly rate) in July. Disposable personal income (DPI)—personal income less personal current taxes— increased $7.3 billion (less than 0.1 percent). Personal outlays—the sum of personal consumption expenditures (PCE), personal interest payments, and personal current transfer payments—increased $153.8 billion (0.8 percent) and consumer spending increased $144.6 billion (0.8 percent).…

Personal Income and Outlays, July 2023

Personal income increased $45.0 billion (0.2 percent at a monthly rate) in July. Disposable personal income (DPI)—personal income less personal current taxes— increased $7.3 billion (less than 0.1 percent). Personal outlays—the sum of personal consumption expenditures (PCE), personal interest payments, and personal current transfer payments—increased $153.8 billion (0.8 percent) and consumer spending increased $144.6 billion (0.8 percent).…

Gross Domestic Product (Second Estimate) Corporate Profits (Preliminary Estimate) Second Quarter 2023

Real gross domestic product (GDP) increased at an annual rate of 2.1 percent in the second quarter of 2023, according to the “second” estimate. In the first quarter, real GDP increased 2.0 percent. The increase in the second quarter primarily reflected increases in consumer spending and business investment that were partly offset by a decrease in exports. Imports, which are a subtraction in the calculation of GDP, decreased.

Gross Domestic Product, Second Quarter 2023 (Second Estimate) and Corporate Profits (Preliminary)

Real gross domestic product (GDP) increased at an annual rate of 2.1 percent in the second quarter of 2023, according to the “second” estimate. In the first quarter, real GDP increased 2.0 percent. The increase in the second quarter primarily reflected increases in consumer spending and business investment that were partly offset by a decrease in exports. Imports, which are a subtraction in the calculation of GDP, decreased. Profits decreased…

Activities of U.S Affiliates of Foreign Multinational Enterprises, 2021

Majority-owned U.S. affiliates of foreign multinational enterprises employed 7.94 million workers in the United States in 2021, a 2.9 percent increase from 7.71 million workers in 2020, according to the U.S. Bureau of Economic Analysis (BEA). These affiliates accounted for 6.2 percent of total private-industry employment in the United States in 2021.

Activities of U.S. Affiliates of Foreign Multinational Enterprises, 2021

Majority-owned U.S. affiliates of foreign multinational enterprises employed 7.94 million workers in the United States in 2021, a 2.9 percent increase from 7.71 million workers in 2020, according to the U.S. Bureau of Economic Analysis (BEA). These affiliates accounted for 6.2 percent of total private-industry employment in the United States in 2021.

June 2023 Trade Gap is $65.5 Billion

The U.S. goods and services trade deficit decreased from $68.3 billion in May (revised) to $65.5 billion in June, as imports decreased more than exports. The goods deficit decreased $2.8 billion to $88.2 billion, and the services surplus decreased less than $0.1 billion to $22.7 billion.

U.S. International Trade in Goods and Services, June 2023

The U.S. monthly international trade deficit decreased in June 2023 according to the U.S. Bureau of Economic Analysis and the U.S. Census Bureau. The deficit decreased from $68.3 billion in May (revised) to $65.5 billion in June as imports decreased more than exports. The goods deficit decreased $2.8 billion in June to $88.2 billion. The services surplus decreased less than $0.1 billion in June to $22.7 billion.

Gross Domestic Product for Puerto Rico, 2021

Real gross domestic product (GDP) for Puerto Rico increased 4.0 percent in 2021 after decreasing 6.2 percent in 2020, according to statistics released today by the U.S. Bureau of Economic Analysis.

The increase in real GDP in 2021 primarily reflected an increase in personal consumption expenditures. Private fixed investment also increased. These increases were partly offset by decreases in exports, private inventory investment, and…

Producto interior bruto para Puerto Rico, 2021

El producto interior bruto real (PIB) para Puerto Rico creció 4.0 por ciento en 2021, luego de decrecer 6.2 por ciento en 2020, de acuerdo con las estadísticas difundidas hoy por el Negociado de Análisis Económico de EE. UU.