Bureau of Economic Analysis

Activities of U.S. Multinational Enterprises, 2023

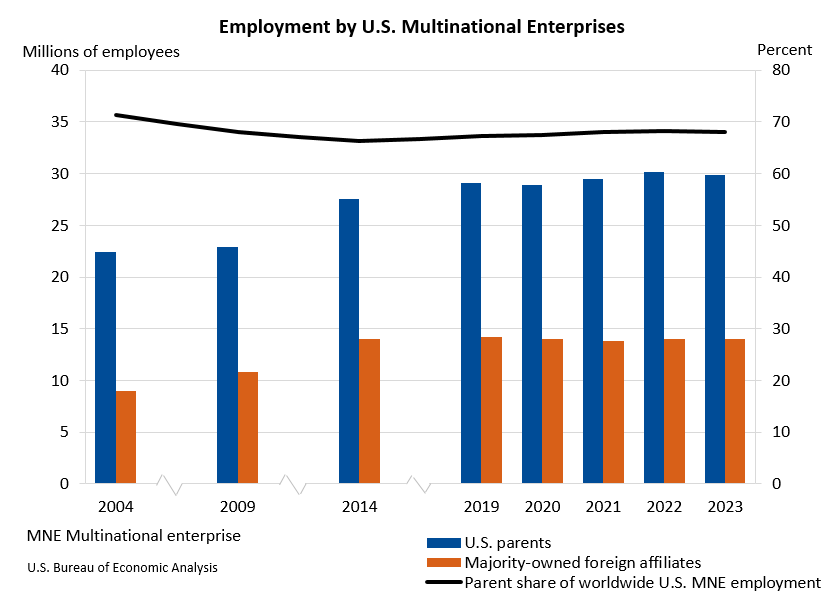

Worldwide employment by U.S. multinational enterprises decreased 0.4 percent to 43.9 million workers in 2023 (preliminary) from 44.1 million workers in 2022 (revised), according to statistics released today by the U.S. Bureau of Economic Analysis on the operations and finances of U.S. parent companies and their foreign affiliates.

Principal Federal Economic Indicators

Noteworthy

- 2025 News Release Schedule

- Innovation at BEA

- 2025 Annual Updates

- Distribution of Personal Income Nowcast

- New! Services Trade Data for More Countries

- Data Tool: Trade in Value Added

- Updated: RIMS II Regional Multipliers

- Arts and Culture

- Space Economy

- FDI Now in State BEARFACTS

- Quick Guide: Price Indexes

The Latest

Gross Domestic Product by State, 4th Quarter 2021

Real gross domestic product (GDP) increased in 47 states and the District of Columbia in the fourth quarter of 2021, as real GDP for the nation increased at an annual rate of 6.9 percent. The percent change in real GDP in the fourth quarter ranged from 10.1 percent in Texas to –2.3 percent in Iowa.

Gross Domestic Product by State, 4th Quarter 2021 and Year 2021 (Preliminary)

Real gross domestic product (GDP) increased in 47 states and the District of Columbia in the fourth quarter of 2021, as real GDP for the nation increased at an annual rate of 6.9 percent, according to statistics released today by the U.S. Bureau of Economic Analysis. The percent change in real GDP in the fourth quarter ranged from 10.1 percent in Texas to –2.3 percent in Iowa.

Personal Income and Outlays, February 2022

Personal income increased $101.5 billion, or 0.5 percent at a monthly rate, while consumer spending increased $34.9 billion, or 0.2 percent, in February. The increase in personal income primarily reflected an increase in compensation of employees that was partly offset by a decrease in government social benefits. The personal saving rate (that is, personal saving as a percentage of disposable personal income) was 6.3 percent in February,…

Personal Income and Outlays, February 2022

Personal income increased $101.5 billion, or 0.5 percent at a monthly rate, while consumer spending increased $34.9 billion, or 0.2 percent, in February. The increase in personal income primarily reflected an increase in compensation of employees that was partly offset by a decrease in government social benefits. The personal saving rate (that is, personal saving as a percentage of disposable personal income) was 6.3 percent in February,…

Gross Domestic Product (Third Estimate), Corporate Profits, and GDP by Industry, Fourth Quarter and Year 2021

Real gross domestic product (GDP) increased at an annual rate of 6.9 percent in the fourth quarter of 2021, following an increase of 2.3 percent in the third quarter. The increase was revised down 0.1 percentage point from the “second” estimate released in February. The acceleration in the fourth quarter was led by an acceleration in inventory investment, upturns in exports and residential fixed investment and an acceleration in consumer…

Gross Domestic Product (Third Estimate), Corporate Profits, and GDP by Industry, Fourth Quarter and Year 2021

Real gross domestic product (GDP) increased at an annual rate of 6.9 percent in the fourth quarter of 2021, following an increase of 2.3 percent in the third quarter. The increase was revised down 0.1 percentage point from the "second" estimate released in February. The acceleration in the fourth quarter was led by an acceleration in inventory investment, upturns in exports and residential fixed investment and an acceleration in…

U.S. International Investment Position, Year 2021

The U.S. net international investment position, the difference between U.S. residents’ foreign financial assets and liabilities, was –$18.10 trillion at the end of 2021, according to statistics released today by the U.S. Bureau of Economic Analysis (BEA). Assets totaled $35.21 trillion, and liabilities were $53.31 trillion. At the end of 2020, the net investment position was –$14.01 trillion.

U.S. International Investment Position, Fourth Quarter 2021

The U.S. net international investment position, the difference between U.S. residents’ foreign financial assets and liabilities, was –$18.10 trillion at the end of the fourth quarter of 2021, according to statistics released today by the U.S. Bureau of Economic Analysis (BEA). Assets totaled $35.21 trillion, and liabilities were $53.31 trillion. At the end of the third quarter, the net investment position was –$16.35 trillion.

U.S. International Investment Position, Fourth Quarter and Year 2021

The U.S. net international investment position (IIP), the difference between U.S. residents’ foreign financial assets and liabilities, was –$18.10 trillion at the end of the fourth quarter of 2021, according to statistics released today by the U.S. Bureau of Economic Analysis (BEA). Assets totaled $35.21 trillion, and liabilities were $53.31 trillion. At the end of the third quarter, the net investment position was –$16.35 trillion.

U.S. Current-Account Deficit Widens in 2021

The U.S. current-account deficit, which reflects the combined balances on trade in goods and services and income flows between U.S. residents and residents of other countries, widened by $205.5 billion, or 33.4 percent, to $821.6 billion in 2021. The widening mostly reflected an expanded deficit on goods. The 2021 deficit was 3.6 percent of current-dollar gross domestic product, up from 2.9 percent in 2020.